The world of blockchain and cryptocurrencies is full of promises to make money fast. But it’s worth knowing if the token you’re holding is part of a sophisticated scam to give away your hard-earned money. Yes, instances of scam tokens are not very hard to find in this market.

The exponential growth of the cryptocurrency industry has given way to many new millionaires and bold success stories. Still, things are not so good in real terms in this market. Cybercriminals noticed the “get-rich-quick” trend of cryptocurrencies and took advantage of this desire of many unwary people. This gave way to many cybercrimes related to cryptocurrencies, including fraudulent or scam tokens. In this article, we will highlight ways to avoid getting into the trap of cryptocurrency scams.

Where to Check DeFi Projects

A rule of thumb for investment is ‘better safe than sorry.’ So, before commencing your investment in the DeFi space, make sure you check them from every angle. Here are some excellent resources for researching about DeFi projects and identifying scam tokens. If you find DeFi interesting, here we introduce ways and some powerful tools for analyzing the DeFi ecosystem to see which projects are better for your choice.

1. Check Key Info

The more data you get about the coin or token you want to invest in, the more informed decision you can make. Websites like CoinGecko give you a lot of helpful information like the market cap, the smart contract address, website, social media, markets, and a lot more. This information can actually tell you more than you think. For example, tokenomics (information about the supplies, token burns, etc.) can help you decide better and get away from the trap of scam tokens.

2. Use DeFi Tools

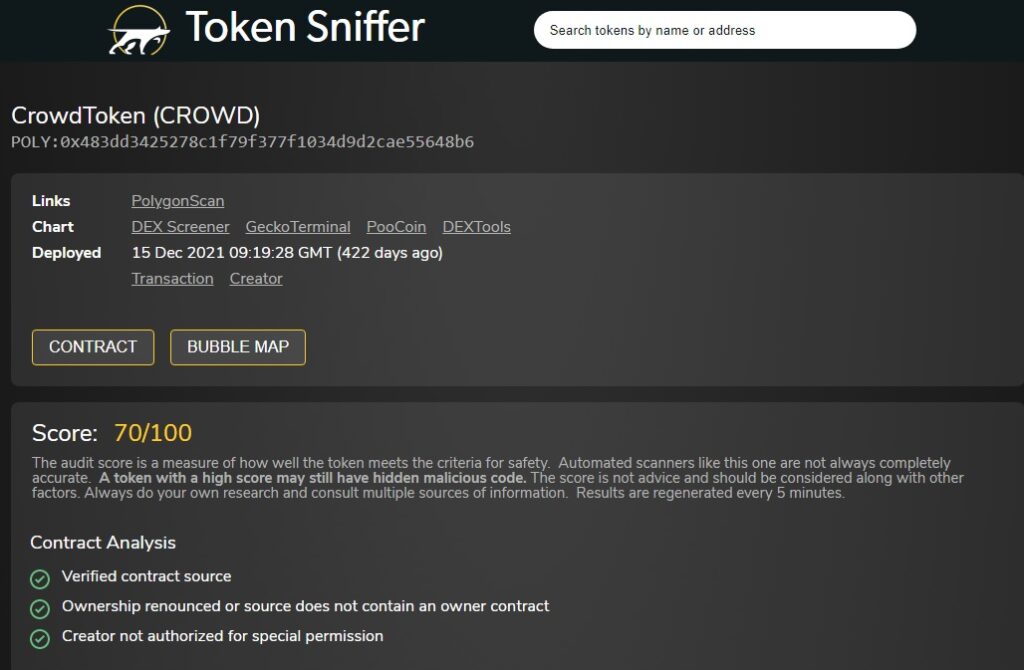

One of the great tools that can be used to see if a token is trustworthy is TokenSniffer. The tool is very convenient, and you can ensure the credibility of any token by searching the name of entering the smart contract address. There is plenty of data that can be accessed on TokenSniffer, and scam tokens are flagged based on this data. If you’re not in for delving into all the information given, the tool gives you an overall score based on the same data.

Another top-rated tool that you can use to get the most information about your desired project is DEX Tools. On this website, you can check the total liquidity of the project, 24h volume, pooled USDT, market cap, and the total number of holders of the token or coin. In addition, you can see the project’s reliability score based on various indices and the community’s trust in the project. Also, the trade history of the coin or token can be easily spotted on this website. Typically, if the trading volume and the total value locked (TVL) seem logical concerning the project, it’s good to go. In our article ‘What is TVL and why it is important?’, we said that TVL could act as a benchmark for the overall conditions of the DeFi ecosystem and individual projects. In addition, it was indicated that TVL is a reference measure for the usage, value, and credibility of a DeFi protocol.

Red Flag! Caution!

You may have been wondering how we can ensure the authenticity of a DeFi project and make sure that it is not a scam token. The good news is that you are not alone, and there are ways to do this. When researching DeFi platforms or projects, there are some features you should bear in mind.

Tempting statistics

A red flag goes up if a project’s scores are too high to be believable. For example, if a project offers extremely high yields or ROI’s that are too high to be believable, so don’t believe it! To raise capital for a scam token, cybercriminals often market their project very heavily to make noise as quickly as possible.

Before investing in a token, check the social media accounts of its developers to see if their marketing tactics include unrealistic promises, misrepresentations, or suspicious statistics. All of these can be warning signs of a scam token.

Unknown team

It is true that DeFi is wholly built on a “decentralized” infrastructure. Still, behind every successful project, there is a strong team! Many scam token developers remain anonymous because they know they will be committing a serious crime in the near future. Of course, a cybercriminal will not publicly confess their identity before deceiving people to obtain illegal money, as this will make it easier for the authorities to catch them red-handed.

While some cryptocurrency scams have had anonymous founders, like Ruja Ignatova (founder of OneCoin), it’s common for these people to hide behind an online identity. Even legitimate cryptocurrency developers like Shiba Inu’s Ryoshi do this. So, if you see a new project hitting the market, but the developer or group of developers are all unknown on social media and other platforms, be careful. While this factor alone cannot confirm that cryptocurrency can be fraudulent, it is certainly something worth noting.

No Audit and Security Data

One of the easiest ways to check the validity of a project is to check if its audit certificates and security reports are published by the project. Since most DeFi projects are open source, such data should be available to the public easily. Since scam tokens are not audited and lack proper security certificates, you won’t see any information on these documents.

To understand this better, search for certificates and reports of strong tokens. To get a gist of what we’re talking about, check the GitHub profile of CrowdSwap from this link.

Master Crypto with Confidence

CrowdSwap's decentralized exchange offers all the DeFi tools you need, with top-notch support at your fingertips

The Bottom Line

Now that the cryptocurrency market has become a huge growth industry, cybercriminals are constantly trying to trick unsuspecting investors. That’s why it’s so important to do your research on a particular token and stay on the lookout for suspicious signs that could indicate a scam.