Welcome to our comprehensive guide on investing in CrowdSwap liquidity pools! If you’re looking to maximize your returns in the dynamic world of decentralized finance (DeFi), you’ve come to the right place. We offer a unique opportunity for crypto enthusiasts to participate in liquidity provision, earning rewards while facilitating seamless token swaps on a decentralized exchange platform. In this blog post, we’ll walk you through everything you need to know about getting started with our liquidity pools, from understanding the basics to implementing advanced strategies. Whether you’re a seasoned DeFi investor or a newcomer exploring new avenues for passive income, join us as we explore the exciting world of liquidity pool investing with CrowdSwap.

Yield farming has become a very popular type of cryptocurrency investment because of its potential for high returns.

To learn more about this topic, we first need to provide simple definitions for “Liquidity Pools” and “Yield Farming” and then discuss investment options in our platform.

What is a liquidity pool?

A liquidity pool is like a shared pot of funds that users contribute to, which enables trading on a decentralized exchange (DEX). Here’s how it works:

Contributing Funds: Users deposit pairs of tokens (like Ethereum and DAI) to the pool. Each liquidity pool has its own pair of tokens.

Balancing Act: The pool strives to maintain a balanced ratio of tokens. For example, if someone adds more Ethereum, they also need to add more DAI to keep the ratio consistent.

Trading Facilitation: When someone wants to trade one token for another, they do it through the liquidity pool. The pool uses smart contracts to execute these trades instantly without a centralized authority.

Fees and Rewards: Users who contribute to the pool typically earn a share of the trading fees generated by the exchange. This incentivizes users to provide liquidity to the pool.

In essence, liquidity pools ensure there are enough funds available for trading various tokens, making transactions smoother and more efficient on decentralized exchanges like CrowdSwap.

Read more: What is a liquidity pool in DeFi?

What is yield farming?

Yield farming, in simple terms, is like gardening for cryptocurrency. Instead of planting seeds and waiting for crops to grow, you’re putting your crypto assets to work in decentralized finance (DeFi) protocols to earn rewards. Here’s how it works:

Providing Liquidity: You start by providing liquidity to decentralized exchanges or lending platforms by depositing your cryptocurrency into special pools called liquidity pools.

Earning Rewards: In return for providing liquidity, you receive rewards, often in the form of additional tokens issued by the protocol or a share of the trading fees generated by the platform.

Strategy and Risks: Yield farming involves strategically choosing which pools to contribute to based on factors like potential returns, risks, and tokenomics. However, it’s important to note that it comes with risks, including impermanent loss (fluctuations in the value of the tokens provided) and smart contract vulnerabilities.

Active Participation: Yield farming requires active participation and monitoring of your investments to maximize returns and manage risks effectively. It’s like tending to a garden, where you need to regularly check on your crops and adjust your strategy based on market conditions.

Overall, yield farming, also called liquidity mining, offers an opportunity to earn passive income by leveraging crypto assets within DeFi protocols. However, it requires careful consideration and active management to be successful.

Read more: What is yield farming? How does yield farming work?

It’s worth mentioning that liquidity mining is a great option during bear markets when cryptocurrency prices tend to be low. By investing in CrowdSwap liquidity pool farming, you can earn additional tokens while holding onto your existing assets. This can help minimize losses and even generate profits during a bear market. Plus, yield farming can also help protect you against inflation, as you earn rewards that keep up with the inflation rate. What else can you do during a bear market? Read more in “How to invest in a bear market?”

Invest in CrowdSwap liquidity pool farming

CrowdSwap is constantly stepping up its game when it comes to yield farming opportunities for users and giving investors more chances to earn rewards on their crypto investments. CrowdSwap is always tweaking and optimizing its yield farming process to ensure users enjoy the game and get the best possible returns. This includes giving more flexibility to choose the tokens they want to use for yield farming.

To learn more about this topic, watch the short video below.

CrowdSwap uses three different methods to simplify its unique process: “Invest by Pair Token,” “Invest by Swap,” and “Invest by Cross-Chain.” Let’s explore each one and discover how you can elevate your yield farming endeavors with this platform.

Remember that each of them is done automatically in the system, and you don’t need to do anything special. This function distinguishes CrowdSwap from other platforms.

Scenario 1: Invest by Pair Token

“Invest by Pair” is incredibly straightforward. You won’t need to worry about token swaps, so that you can avoid issues such as the “high price impact” error or the high demand during the liquidity pool’s launch. To use this method, you’ll need to have both tokens in the liquidity pool pair and allocate an equal value to both tokens.

Learn more: Price Impact vs. Price Slippage in Liquidity Pools

For example, suppose you have $200 worth of tokens A and B. If Token A costs $1 and Token B costs $2, you’ll need to put 100 of Token A (worth $100) and 50 of Token B (also worth $100) in a liquidity pool. This means you can invest in a liquidity pool without having to swap tokens or deal with unexpected complications. Let’s dive into a more practical example.

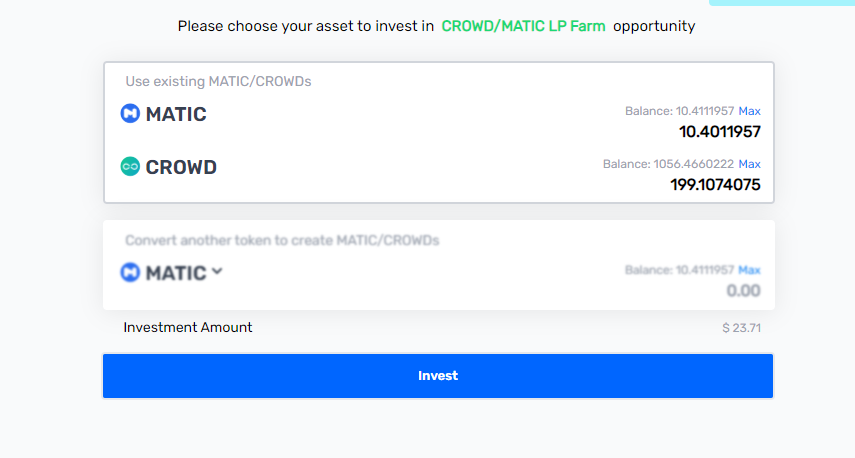

In the above example, the user has both MATIC and CROWD tokens in their wallet. The app automatically calculates the amount of both tokens needed (in dollars) based on the current market price, creating a pair. Once you hit the “Invest” button, you’re all set!

Scenario 2: Invest by Swap

Imagine you’re interested in investing in a liquidity pool that requires both Token A and Token B, but you only have Token A. This is where “Invest by Swap” comes in handy. CrowdSwap will automatically swap half of your Token A for an equal value of Token B and create a pair for you in the liquidity pool. This means you don’t have to worry about buying Token B from an exchange or finding a way to swap it yourself.

The beauty of this option is that it simplifies the investment process, making it easier for those who only have one token to participate in liquidity pools. The system takes care of the swap for you, which can be a huge relief if you’re unfamiliar with swapping tokens on your own. But that’s not all! This option also comes in handy if you have a token other than the pair but on the same network. Let’s make it a bit more real-world.

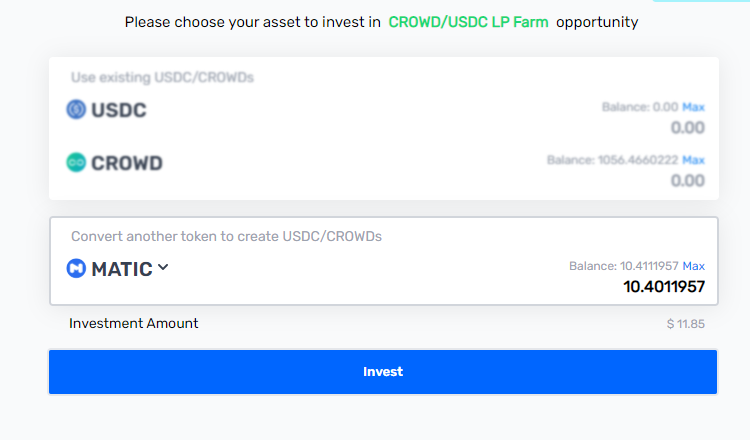

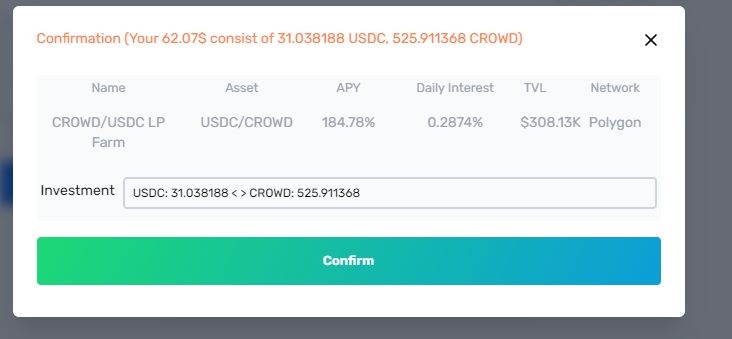

In the above example, the user has MATIC on their wallet, which is on the same network (Polygon) as the chosen liquidity pool on CrowdSwap (USDC/CROWD). The system swaps the selected amount of MATIC for an equal amount of USDC and CROWD. The system will then prompt you to confirm the transaction, and that’s it.

It’s important to note that this method only works if the token of your choice (MATIC) and the token pair (USDC/CROWD) are on the same network (in this case, Polygon). If they are not, “Invest by Cross-Chain” comes in.

Scenario 3: Invest by Cross-Chain

Imagine you have a token you’d like to invest in a liquidity pool, but it’s not on the same network as the tokens in the pool. “Invest by Cross-Chain” is useful in such a scenario. With this method, the CrowdSwap platform will automatically swap your token for an equal value of Token A and Token B, which are the tokens in the liquidity pool pair. Once the swap is complete, the system will create a pair for you in the liquidity pool. This procedure is called “Fast Lane Transaction.” It’s important to mention that only CrowdSwap has this feature. Fast Lane Transaction allows you to participate in any liquidity pool with any token in our supported networks without acquiring the necessary pair of tokens for each farm.

This feature allows you to invest in a liquidity pool even if you don’t have the same tokens as the pool requires. This means you don’t have to go through the hassle of swapping your token for the required tokens on an exchange or through a complicated process. We have made it as simple as possible, allowing you to invest in the liquidity pool with just a few clicks.

Let’s say you have $200 worth of Token C, which is not on the same network as Token A and Token B, the tokens in the liquidity pool pair. Token C is worth $4 per token, so you have a total of 50 Token C. To invest in the liquidity pool, you would need to swap your Token C for Token A and Token B. However, this can be a complicated process involving multiple steps, such as finding a cross-chain DEX platform or using a centralized exchange. With the “Invest by Cross-Chain” method on our platform, you can easily invest in the liquidity pool without having to go through all of these steps. Here’s how it works:

Imagine you enter the amount of Token C you want to invest, which is $200 in this example.

The CrowdSwap system calculates the value of Token A and Token B based on their current market prices. Let’s say Token A is worth $1 and Token B is worth $2.

The system automatically swaps your $200 worth of Token C for an equal value of Token A and Token B. This means you would receive 100 Token A and 50 Token B in exchange for your 50 Token C.

The system creates a pair in the liquidity pool with your 100 Token A and 50 Token B.

So, in the end, you are able to invest in the liquidity pool with Token A and Token B without having to go through the complicated process of swapping your Token C for them on your own. Our platform handles all the details for you, making it a simple and easy process. An example from the CrowdSwap app would look like this:

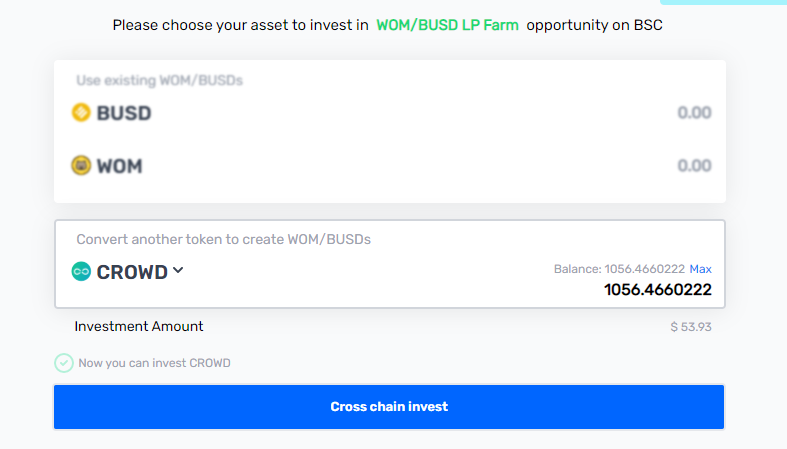

In the example above, the user chose to invest in the WOM/BUSD liquidity pool. Since the liquidity pool is on the BNB Smart Chain (BSC) network, and the user’s funds (CROWD) are on the Polygon network, a cross-chain solution is selected for them. By hitting the “Invest” button, the system conducts a cross-chain swap and creates the liquidity pool with BUSD and WOM tokens. Easy, right? That’s how CrowdSwap makes things easy for its users.

The CrowdSwap platform handles the calculations and swaps necessary to invest in the liquidity pool in all three methods. This makes it easier for users to participate in liquidity pools without dealing with the complexities of token swapping themselves. So, all you need to do is decide to do it!

Check top CrowdSwap Yield Farming opportunities:

How to withdraw the pool rewards?

Now that you have made your investment using one of the three methods provided by CrowdSwap, you can sit back and watch your investment grow. As more people trade the tokens in the liquidity pool, the price may fluctuate, leading to potential profits. When you’re ready to withdraw your rewards, CrowdSwap provides an easy-to-use interface that guides you through the process. It’s good to mention that rewards are paid by CROWD.

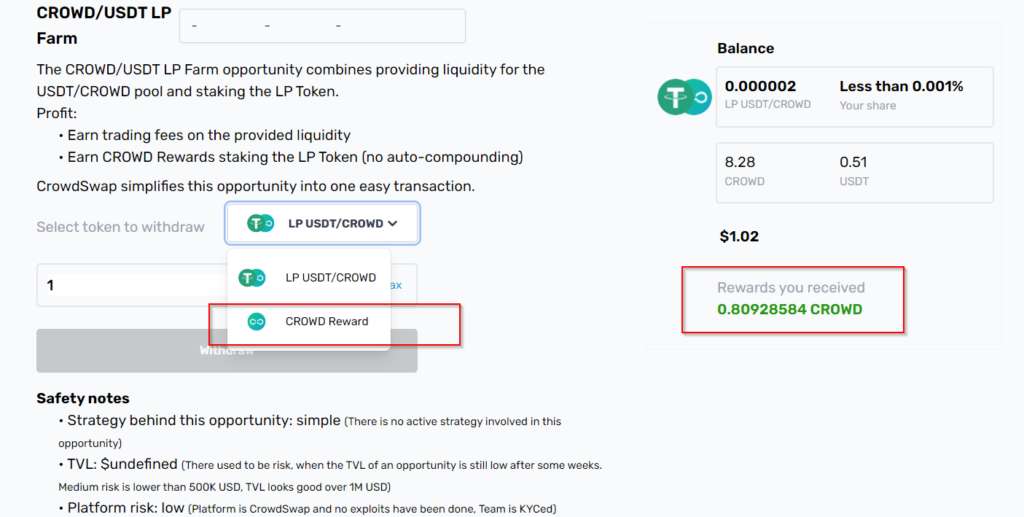

By selecting the option to withdraw rewards from the drop-down menu in your account and the investments part, you can easily transfer your earnings directly to your wallet. Simply select the option “CROWD Reward” from the menu, and the funds will be transferred to the same wallet address you used for your investment.

Just a quick reminder: The tokens you earn as rewards may vary based on your chosen investment option. So, if you invest in a CrowdSwap opportunity, you’ll get paid in CROWD tokens, but other platforms might pay you out in different tokens. For instance, PancakeSwap earning plans will give you the rewards in CAKE.

Master Crypto with Confidence

CrowdSwap's decentralized exchange offers all the DeFi tools you need, with top-notch support at your fingertips

Wrap-Up

Liquidity farming with CrowdSwap offers a beneficial opportunity, but it’s essential to understand the landscape beforehand. With its user-friendly interface and versatile options, this platform is a convenient hub for decentralized finance enthusiasts. Whether you possess both tokens, just one, or tokens across different networks, CrowdSwap simplifies the process, making participation in liquidity pools accessible to all. By prioritizing simplicity and accessibility, We aim to democratize DeFi for everyone. Say goodbye to investment stress and embrace the ease of navigating liquidity pools with CrowdSwap. Remember, staying informed about market conditions and token performance is crucial for making informed investment decisions. Keep a close eye on the market, and remember: patience is key in the world of finance!

Read more: Popular Questions About CrowdSwap Liquidity Pools

FAQ

What is a Liquidity Pool?

A liquidity pool is a smart contract that holds a pair of tokens, allowing users to trade between them. Users provide liquidity by depositing an equal value of both tokens, enabling others to trade. Liquidity providers earn a portion of the fees generated from these transactions

What are the top CrowdSwap yield farming options?

Check this page, please: Yield Farming. Top CrowdSwap Yield Farming Opportunities are mentioned there, and you can easily start investing

Can I withdraw my funds at any time?

You can usually withdraw your funds from a liquidity pool at any time. However, fees and potential consequences, such as impermanent loss, may be included. Review the platform’s terms and conditions for specific details