In the world of cryptocurrencies, and more precisely, decentralized peer-to-peer finances or DeFi, yield farming is one of the most beneficial quick-yet-legitimate-bucks get-in tickets.

Let’s dive into the heart of the matter with departing links on what’s DeFi from Investopedia for those who need it.

What is Yield Farming?

Although tapping into the DeFi system means removing third parties and intermediaries, investing in such spaces requires money and money pools.

In CrowdSwap, like other same-category DeFi platforms, smart contracts are written to initiate pools. After the codings, it’s time for the people like you to play their part and loan their assets to the liquidity pool to render it operational!

As more and more investors pile in, the collection grows, bringing in potential users, which grants liquidity providers incentives in transactional fees.

We call these investors “yield farmers” or “liquidity providers;” and what their hash as yield farming.

How Does Yield Farming Work?

Suppose you have some capital or an amount of digital currency, and you want to make a profit out of it. You find one of these aforementioned liquidity pools and put some or all of your assets.

However, there’s a catch!

You see, liquidity pools only accept pairs of digital currencies. So, you have to divide your assets in half and use each half to buy different digital currencies. The system receives your assets, and you will be rewarded for every transaction or financial activity others do with your money.

It doesn’t stop there, though!

The system also gives you a token based on your investment amount, which you can use in other liquidity pools. You can stack and profit from it, which sounds just marvelously easy money-in-the-pocket.

CrowdSwap offers a safe and transparent yield farming system providing this dripping income effect through only one investment while minimizing risks.

That said, it’s natural and critical to learn about the risks before diving into the procedure.

What Are The Cons of Yield Farming?

Investing in financial pools is only sometimes beneficial; other times, investors might gain less than they desire.

One of such lesser-fortunate instances is widely known as impermanent loss. This loss is temporary and only becomes permanent if you decide to withdraw your investment from the pool.

In general, you only suffer impermanent loss when assets drecrease in value due to liquidity pool activities in camparison to the time of deposit.

For example, you have invested 100 USDT (~US$100) alongside 500 Basic Attention Tokens (~US$100). Whenever the BAT (Basic Attention Token) fluctuates in value in correlation with USDT, you will be exposed to impermanent loss (at the time of writing this article, 1 USDT equals ~ 0.27 BAT).

Keep in mind that if you kept holding the money in your wallet, you could benefit more, but now you have gained less profit. It does not mean you have lost your asset.

But How to Avoid Impermanent Loss?

One way is investing using Stablecoin Yield Farming; since stablecoins have a more stable value, they create a wider margin of safety for you as an investor.

Another method is paying attention to the popularity of the pool. The TVL, or Total Value Locked index, indicates how much capital is inside a liquidity pool.

Yet yield farming is very complex.

You must constantly check the amount of profit or loss and watch if the value of cryptocurrencies has changed, making everything very delicate and somewhat tricky to some souls. (If you’re wondering how to calculate it, you can do the math here.)

Fortunately for those souls, CrowdSwap can aid you there.

Managing a Successful Yield Farm on CrowdSwap

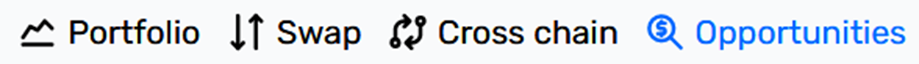

Firstly, click “Launch the App” and select ”Opportunities.”

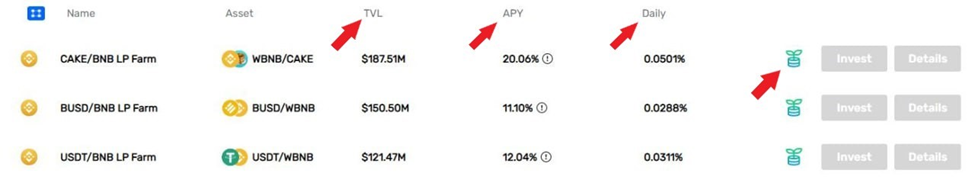

Now, several investment opportunities will be available. Among these options, ones with signs are yield farming investments.

The indicators that help you find the best investment opportunity among the available options are TVL, APY, and daily indicators.

TVL: total funds locked in a pool. It indicates the popularity of one liquidity pool compared to another.

APY: Annual Percentage Yield is the annual investment return, including the compound interest.

Daily: merely the daily profit.

Memorize them while looking for the best investment opportunity among various sites and comparing them because they’re all you will need.

Also, having one of the two tokens or currencies isn’t a problem, and you can continue with your investment.

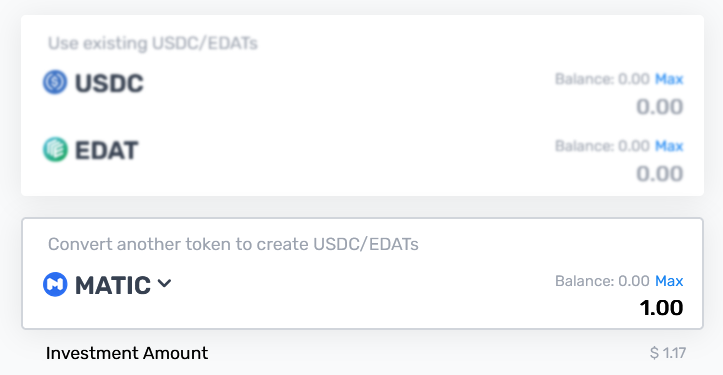

Now, it’s time to invest. Hit the “Invest” button.

After clicking the blue button, the dApp will ask you to specify the investment amount, as below:

And will automatically split the investment into half USDC (in this case) and half EDAT (if you only have one of the two).

Of course, you could also do the swapping yourself. However, we recommend CrowdSwap algorithms since they pinpoint the best routing with the lowest fee and, thus, the highest efficiency. CrowdSwap’s Portfolio Manager can also be a big helper in finding the best deal and general opportunity layouts.

Note: You can check CrowdSwap Whitepaper, section 3.9, Opportunities, for a more thorough read.

Congratulations, you’re now a yield farmer and officially in business. May your investments be plentiful and bountiful.

Now then, are you ready to try your one, have you seen our top opportunities?

Master Crypto with Confidence

CrowdSwap's decentralized exchange offers all the DeFi tools you need, with top-notch support at your fingertips

As always, come to us with any difficulties and questions regarding yield farming and operating the application.