DeFi (Decentralised Finance) has become a buzzword in the world of finance and blockchain these days. The idea behind it is pretty simple: facilitating the current economic affairs in a decentralised space. Perhaps a decade ago, no one would imagine a day would come when a person would be able to do all his financial affairs with only a smart phone and an Internet connection. Aside from this ease of use, DeFi enjoys other key advantages. Nearly instant settlement, being transparent, and of course, being decentral are some of the key advantages of this innovative financial trend. But naturally, a new technology often faces some objections from governments until rules and regulations are defined for it. In this post, we discuss the regulations that are set on DeFi so far and its future developments.

How practical is DeFi?

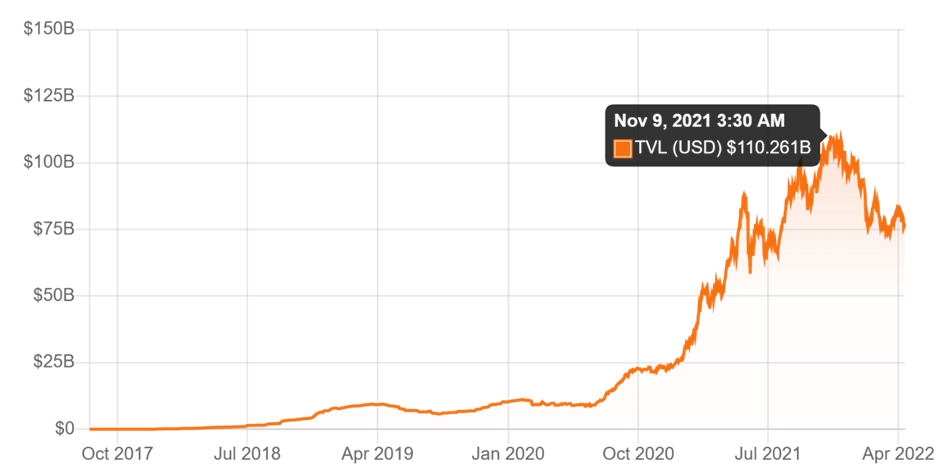

Recent years has seen a tremendous rise in interest towards the field of decentralised finance. This skyrocketing demand was followed by a dramatic growth in the amount of investment in DeFi protocols. The amount of investment in DeFi protocols is reported in terms of Total Value Locked (TVL). This value in 2021 started off with $26 billion and then surged over 320% and peaked to $110 billion by the end of the year to set an all-time-high record.

This rise in public and institutional demand and interest in the world of DeFi is not a mere coincidence. It shows that the idea is intriguing enough to attract such an investment to it. But is it practical as well? In a nutshell, yes! Currently, there are many strong projects that are working in DeFi, either in lending and borrowing, or earning interest on assets. So in that sense, it is being used by many people around the world. But there are still some concerns by governments for its widespread use.

Is DeFi Legal?

For decades, the issue of trust revolved around regulating the intermediaries (i.e. banks and financial institutions). A person would choose to do business with a bank that was approved by the government. Even conducting a transaction between two people had to be endorsed by a trusted third party to be approved. But what if we remove that third party? In that case, the concept of trust would naturally be a challenged. So, there is a need to redefine the notions of trust and regulation.

History has shown that whenever a new technology is introduced, governments are sceptical towards it at first. As time goes by, governments set regulations for it so that it can fit into a framework that is understandable and acceptable. DeFi is no exception to this fact. The undeniable fact is that using a new financial system comes with its own risks. As DeFi attracts more attention, instances of fraud and scam projects in the ecosystem are heard from time to time, which necessitates a careful thought into fitting it into a regulatory framework.

As a result, in order for the DeFi ecosystem to be able to be used widespread, it needs to be regulated. An approach should be taken that does not curb or restrict the flourishment of a new trend that could solve many current financial issues. Conversely, efforts should be made to take best advantage of the potentials of DeFi not just in the crypto space, but also in real life, like real estate. But how regulators act is an intricate issue that regulatory bodies should give a good thought.

How DeFi Should Be Regulated?

Although the first reaction of most governments in the face of a decentralised financial protocol was a crackdown on it, they are beginning to think more rationally while the tantrum is cooling down. Regulators can generally take two standpoints in this regard. The first one could be to try to restrict DeFi into the existing prescribed frameworks until it feels logical. Such a constraining perspective cannot be constructive because it curbs the true potentials of DeFi. It is like fitting a V-12 engine under the hood of a small car.

Another approach could be to set new regulations that do not restrict DeFi, but even foresee the endless possibilities that it offers for the future world. In doing so, some regulators require know-your-customer (KYC) mechanisms to be done before starting transactions. They may also require KYC for addresses that transfer amounts surpassing a certain limit. Hopefully, there are projects that are working in this field to contribute to safer, more secure transactions, while the privacy of data is ensured. Fractal Protocol is one of the projects that provides decentralised identities (DIDs) with the aim of facilitating user IDs and giving them the authority over their own ID and whom they share it with in a private, yet transparent manner.

The Role of DeFi Ecosystem

In order to be able to comply with the existing regulations, DeFi projects can interact closely with users and regulators. By providing incentives to their users to conduct KYC procedures, DeFi protocols can help eliminate the concerns regarding money laundering and the possibility of fraud and scam. This way, if all the people who are doing business on a decentralised finance platform have already done their KYC, then why worry if your counterparty is a fraud or has a criminal record? For example, in a peer-to-peer (P2P) transaction, although users may not know who they are doing transaction with, but they can be sure that everyone who is working on that particular platform is known by a regulatory.

Alternatively, a scoring mechanism can be ideal to make sure that addresses are on the right track. This can be done by making minor modifications to the scoring mechanism that is already being used by credit companies. DeFi users can increase their score by conducting legit transactions with addresses that have not done any suspicious activities. An address with a high score can enjoy the benefits of higher amounts of transfer.

Navigate the Crypto Market Like a Pro

Try CrowdSwap and boost your earnings with ease on our decentralized exchange

Final Remarks

DeFi is a very promising solution that is still in its infancy stages. Taking a coercive approach towards it can be potentially harmful for the entire ecosystem. On the other hand, the true potentials of this innovative sector can be unlocked if all its aspects are taken into account. Any approach that regulators take should consider the potentials and unique characteristics of DeFi. With fast and secure settlement thanks to the blockchain network, and its automated nature because of using smart contracts, DeFi can provide solutions for many problems that exist in the traditional finance.