Bear market investment

So, you’ve invested in the cryptocurrency market and made a good profit out of its innate volatility. You’ve come a long way, endured a lot of stress, and seen a lot of dips that turned out to be simple corrections, after which the bull market has continued its way upwards. Everything points to the fact that the market is bullish, and now you are used to these dips as a part of the volatility. One day, another dip comes, and you react as always: keep calm. Then out of nowhere, a heavier correction follows. You get frustrated and start blaming yourself for not acting sooner. Now, you start thinking about reactions that you don’t normally consider. Welcome to the bearish market!

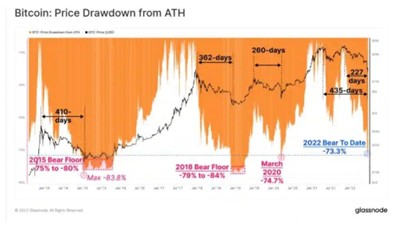

How long does a bear market last

A bear market typically starts with a regular dip that happens in every bull market structure. Most investors think that they’ve failed to sell on time, but historically, bear markets last long enough to let investors modify their investment strategies. In the 2019-2020 period, the downtrend lasted 260 days, during which BTC lost over 80% of its value. Similarly, the 2015 bearish structure, in which BTC fell almost 75% from its ATH, lasted 410 days. The current bear market that we are in has lasted 290 days so far, with BTC down 75% from its ATH.

How to react to the bearish market

People react differently to the bearish market, the worst of which is inaction! Remaining paralyzed in hope for the return of “the good old days” may be the worst possible reaction. Of course, there is not a one-size-fits-all solution to invest in bear market, but it is good to know how successful investors work during one. By reading this article, you can develop a mindset to alter your strategies to minimize your loss or even make a profit in a bear market.

It is also important to keep in mind that based on the market you are working in, your strategies may differ. This is mainly because different markets have different investment opportunities specific to them that you need to consider. Because the main focus of this article is to introduce the opportunities that exist in the cryptocurrency market, the options that you can consider are very impressive and countless. So, let’s dive in.

Staking

Proof-of-stake (PoS) is one of the very common consensus mechanisms that require the members of the community to lock their assets to be able to participate in the security and stability of that blockchain network and receive a reward in return. Protocols like Cardano (ADA), Solana (SOL), and Algorand (ALGO) use this kind of consensus mechanism. No matter where your crypto assets are stored, be it in an exchange or a wallet, you can stake (lock) your tokens to earn the reward.

There are two main types of staking: locked and flexible. In locked staking, you agree to stake your assets for a certain amount of time to get the rewards, whereas, in flexible staking, you can unstake your assets any time you want. Normally, locked staking generates more rewards than flexible staking.

The key thing to bear in mind here is that staking can be a good idea only if you plan to keep your assets and not sell them. For instance, for a Cardano holder who does not intend to sell his tokens no matter if the market is bullish or bearish, staking may be a viable option. But obviously, if an investor’s strategy is to buy lower and sell higher, staking may not apply depending on how long they are planning to hold the asset.

Staking opportunities are abundant in the crypto market, and that’s why choosing the one that meets your needs is fairly a challenging job. CrowdSwap is one of those DeFi protocols that offers the staking option of its native token (CROWD). Called ‘CROWD Staking’, the project offers a remarkable annual percentage yield (APY) of 25% for those who hold the crypto. To start staking, click here to launch the CrowdSwap application and follow the easy steps.

Yield farming

Yield Farming is a way to earn cryptocurrency using another cryptocurrency you already own. In a broad sense, Yield Farming is any effort to work with your crypto assets and get the maximum profit from them. Yield Farming is the practice of staking or freezing cryptocurrencies in exchange for a reward. While the expectation of return on investment is nothing new, the general concept of yield farming originated from the decentralized finance (DeFi) sector. The general idea is that people can earn tokens in exchange for participating in DeFi applications.

Although it may seem that yield farming is the same as staking, the mechanics are quite different. Unlike speakers who are concerned about the security and stability of the blockchain network, yield farmers’ only goal is to make a profit by providing liquidity to a DeFi protocol. By providing liquidity, yield farmers actually participate in different projects, be it a decentralized exchange (DEX) or a lending protocol, or the like.

However, yield farming is not risk-free, plus the profit you get is not a fixed one and can vary depending on the project that you have invested in. On the other hand, different countries set different regulations for DeFi, which you need to take into account.

CrowdSwap offers diverse yield farming opportunities on different chains. Currently, users can use various options on two common blockchains: BNB Smart Chain (BSC) and Polygon (MATIC). These include CAKE-BNB, BUSD-BNB, USDC-MAI, and many others, and the list is growing. To consult the complete list of liquidity pools, visit this page.

Lending

Lending is one of the fascinating features of DeFi, which has attracted a lot of attention in recent years. These platforms enable users to lend and borrow crypto assets as an alternative to the traditional banking systems. By lending your assets to a lending platform like AAVE or COMPOUND, you can receive rewards in return. The process happens in a peer-to-peer manner through a smart contract, and there is no intermediary.

High-interest rates are the incentives that lending protocols offer to attract investment by lenders. These rates may sometimes be up to 20% APY, but you need to be aware of the risks. The risks of lending and borrowing crypto assets stem from the high volatility of the cryptocurrency market, which leads to the rapid change in the value of the assets.

Mining

Another way to earn profit in a downward market is mining crypto. Basically, mining is the process of solving complex mathematical equations with the help of devices called mining hardware to receive a reward. Mining can be used for tokens that use the proof-of-work (PoW) consensus mechanism like Bitcoin. It is a good way of making passive income, but there are some things that you need to consider about it.

Mining Bitcoin used to be a lot easier and more profitable years ago, and as time goes by, it gets harder. Bitcoin’s rewards to miners get halved every four years with the aim of keeping it scarce and preventing inflation. In 2009, the reward per block was 50BTC, which was distributed to the miners. However, after three halvings that took place, now the reward is 6.25BTC per block.

As it gets harder to mine Bitcoin, you’re gonna need stronger and more expensive mining hardware to earn a decent reward. What you need to consider if you plan to mine Bitcoin is the cost you pay and the income you earn instead. The profit of mining depends on different factors like your hardware’s processing power and power consumption, as well as the cost of electricity. Make sure you calculate the cost and the income, and the net profit you are left with.

Play-to-Earn/Move-to-Earn

Perhaps playing a game while the market is going down could calm you down a bit, especially games that make you some money! In the crypto world, you can find games that users can play to earn. These games give you tokens as you play, and you can sell them in the market any time you want. One of the most famous play-to-earn games is Axie Infinity, which gives you SLP tokens if you win.

Another type of these “-to-earn” apps is move-to-earn apps that give you tokens for a good cause. They give you tokens in exchange for going outside of your home and exercising. The most popular of these apps is STEPN, which gives GST tokens to users who go out and walk, jog or run. After all, every investor needs to have some time off to get his head clear with some recreational activities to be able to get back to work stronger! So, why not do some sport?

But playing and moving to earn is not free, and it requires some tokens to inves in the form of non-fungible tokens (NFTs). For example, in order to be able to play Axie Infinity, you’re gonna need to purchase at least three Axis, which you can sell later, of course. In the case of STEPN, the user has to buy a pair of shoes to be able to start exercising.

Master Crypto with Confidence

CrowdSwap's decentralized exchange offers all the DeFi tools you need, with top-notch support at your fingertips

Final Remarks

Investment in every financial market requires the investor to have a set of strategies. Apart from the strategies that are typical of all financial markets, knowing how the specific market you have invested in works is imperative. When the market is booming, investors follow strategies that may not work during the time when the market is going down. Therefore, investing in the bullish market is different from what you can do when the bearish phase comes. This is why you need to prepare yourself for both bullish and bearish scenarios.