In the fast-paced world of trading and investment, time is of the essence. Traders and investors often find themselves in situations where closely monitoring the market becomes challenging. The volatility of market prices adds another layer of complexity, making it crucial to have tools that provide flexibility and autonomy.

CrowdSwap has recently introduced the Limit Order feature to its cross-chain transactions. Decentralized exchange limit order allows users to predetermine their transaction prices. With the ability to set up transactions at desired prices, users gain a strategic advantage, eliminating the need for constant vigilance over market fluctuations.

CrowdSwap Exchange

What is a decentralized exchange limit order?

A decentralized exchange limit order empowers users to take control of their transactions by setting specific prices, ensuring that cross-chain transactions are executed automatically when market conditions align with their preferences.

With the limit order feature, users no longer need to monitor market fluctuations constantly. Instead, they can pre-set the exact price for executing their trade. Once these conditions are met, their transaction will be processed automatically.

Read more: What Are Cross Chain Swaps?

How to use the decentralized exchange limit order feature on CrowdSwap

To use the limit order feature, follow these steps:

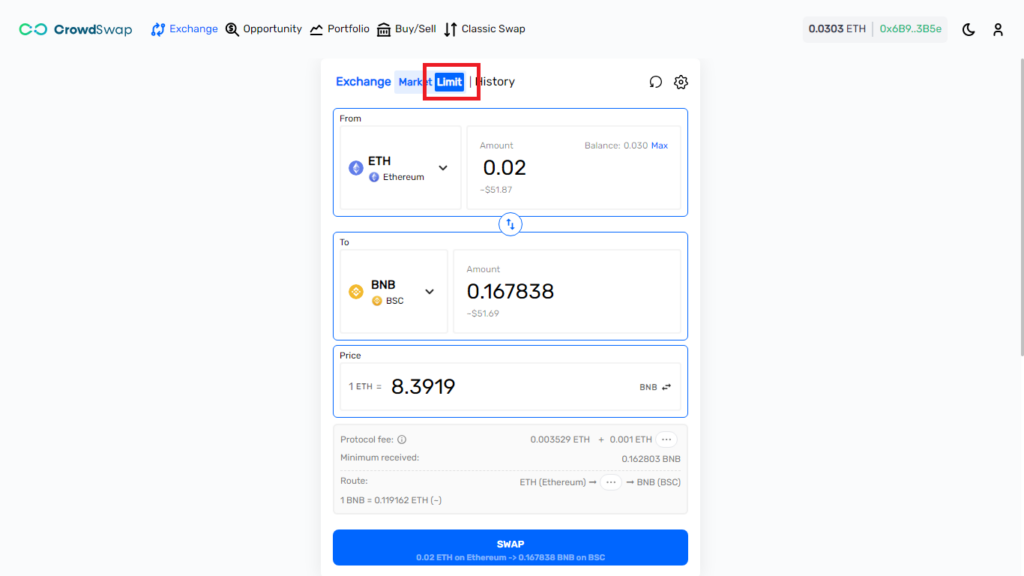

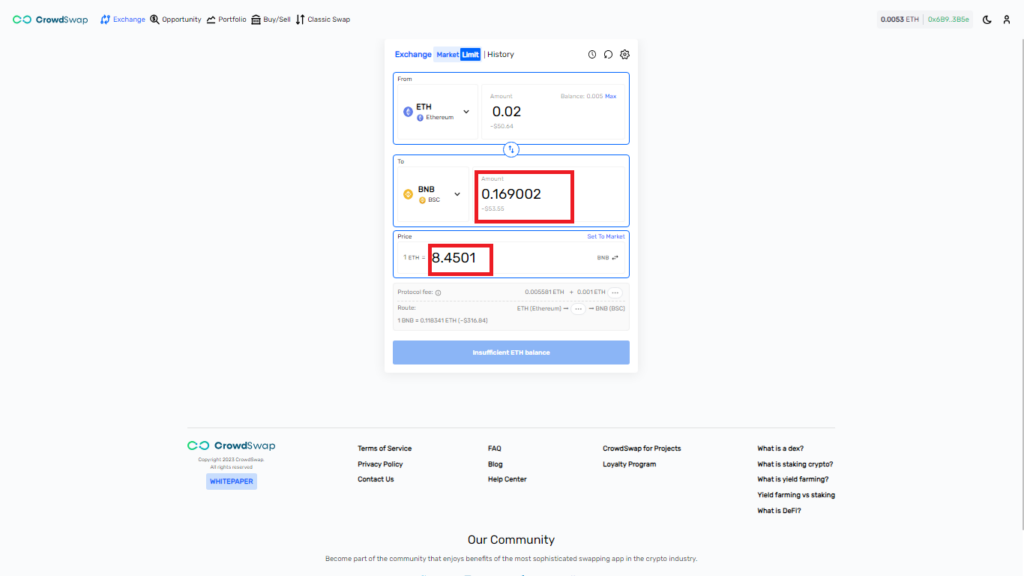

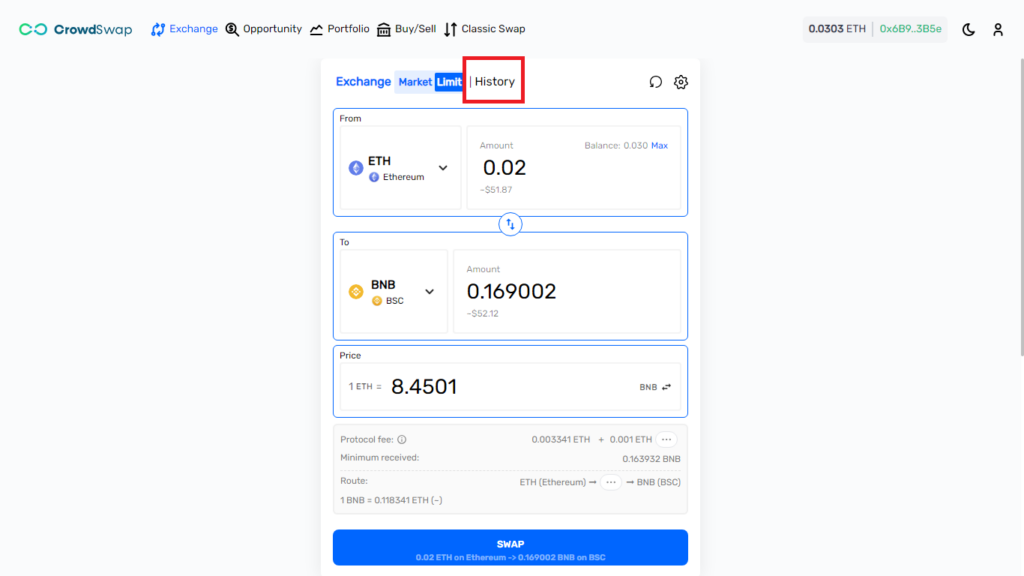

- On the Exchange page, select the Limit tab.

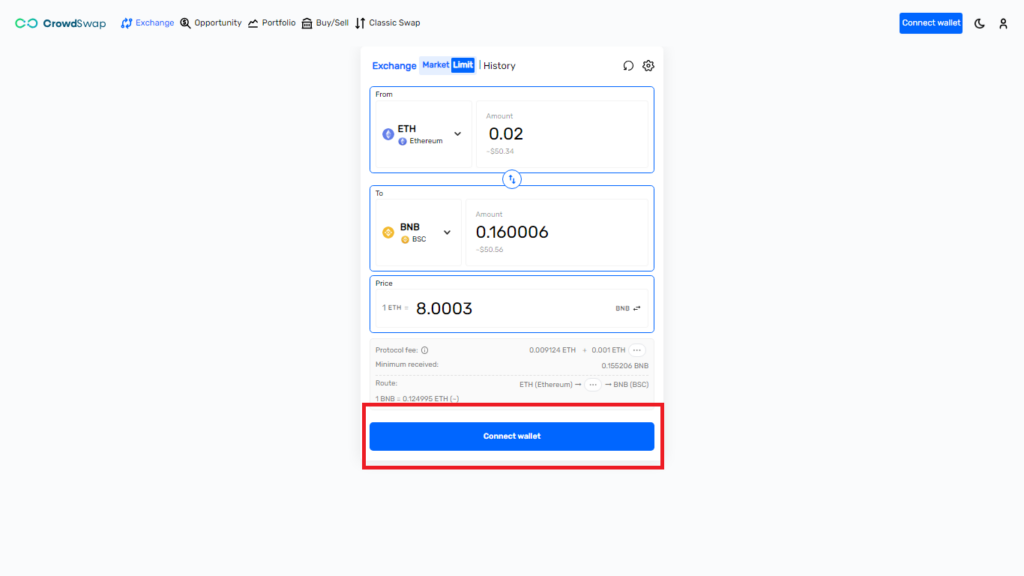

2. Connect your wallet

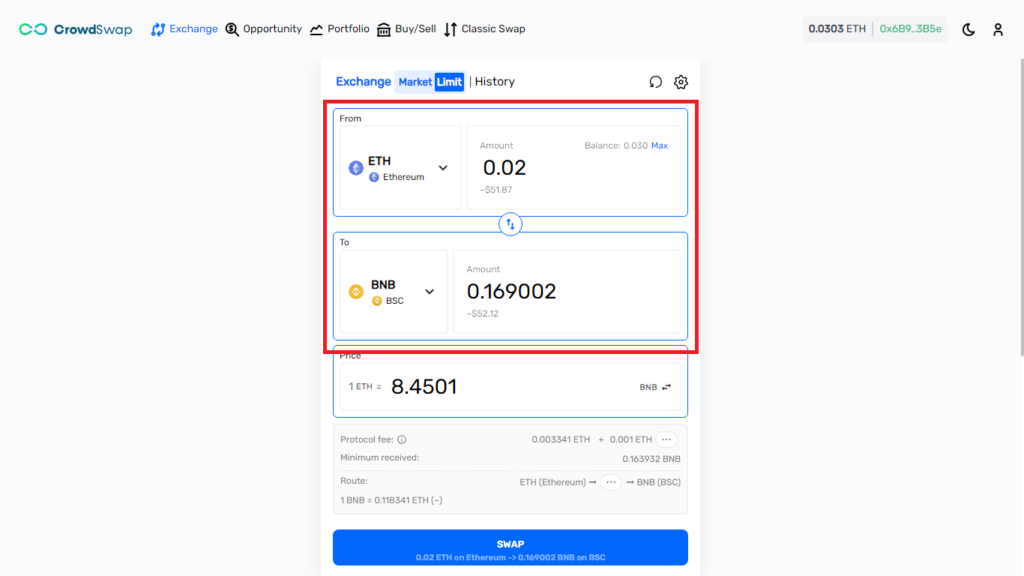

3. Choose the source and destination tokens and networks for your cross-chain

4. In the “From” field, enter the amount of the source token

5. In the “to” field, enter your target amount. Or, in the “price” field, set your target price

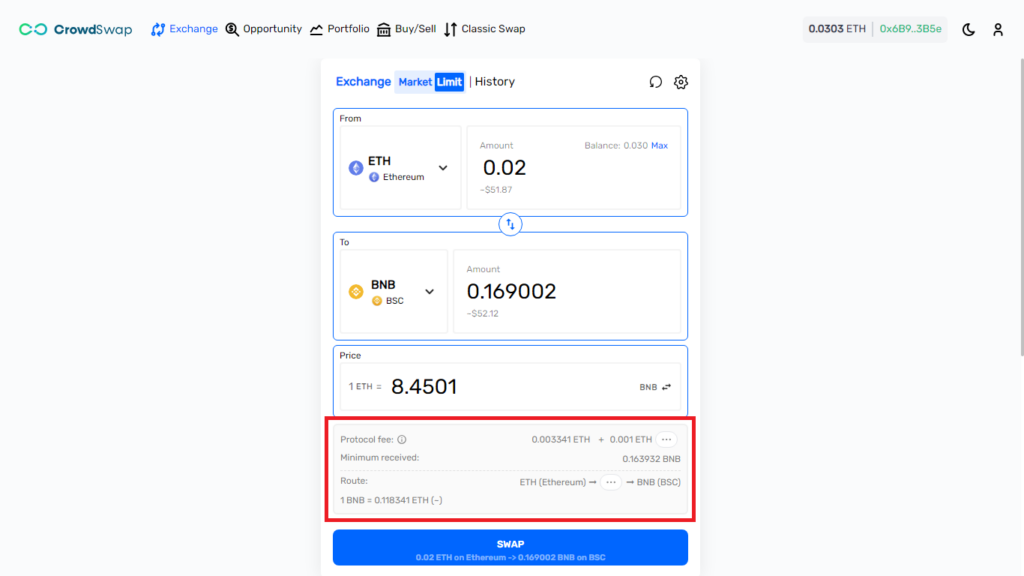

6. Review the details of your order, such as the estimated fee

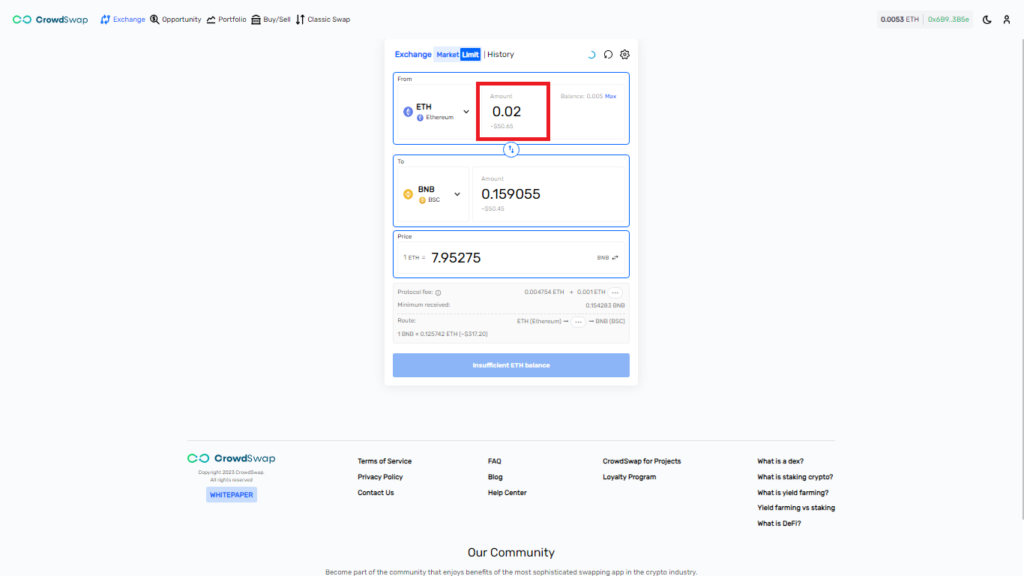

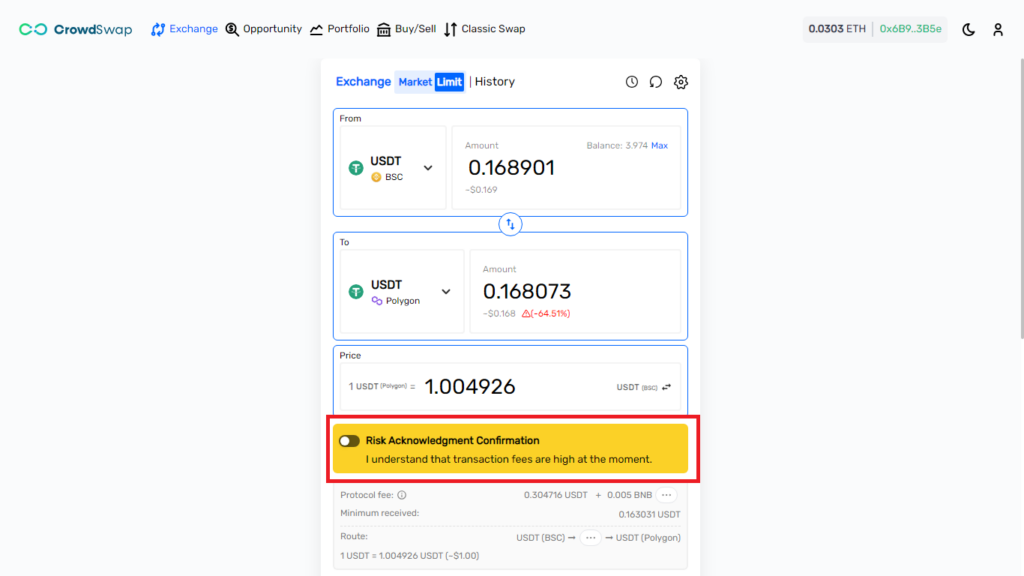

7. If your order results in a loss of more than 5%, you will see a warning message, and the order will be blocked. You can either click the Market button to update your order to the current market price or perform an instant cross-chain swap instead

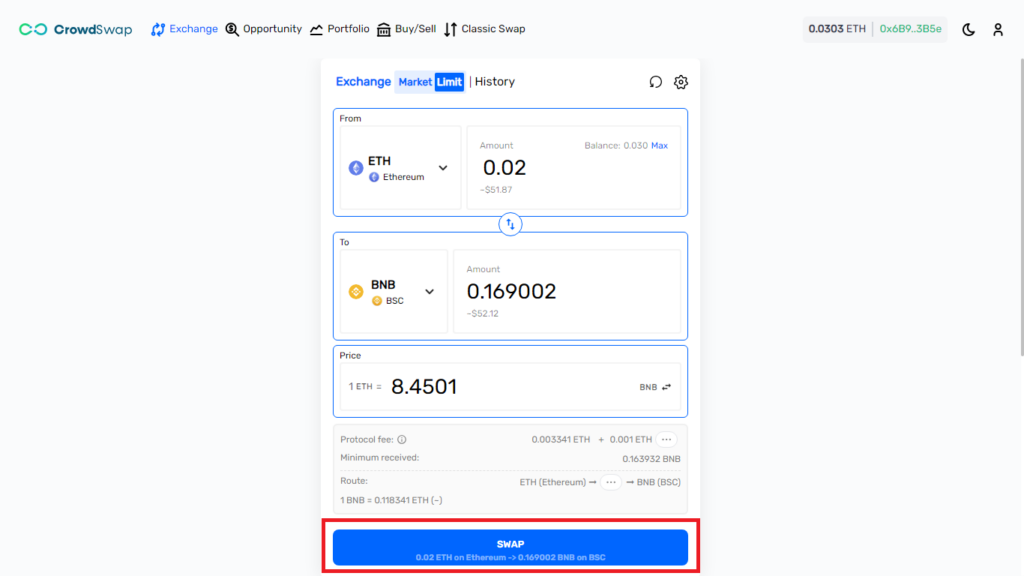

8. When you are satisfied with your order, click the Swap button

9. Confirm the transaction on your wallet; you’ll need to wait for the transaction to be approved on the network.

Note: You can track the status of your order in the History tab.

The limit order feature has some limitations in the first version:

- It only supports cross-chain swaps

- It does not support CROWD bridge

- Selling CROWD with limit order is not possible

- It is not available for zkSync and Optimism blockchains and some tokens

- It does not support the slippage and transaction deadline

Limit order vs market order

Understanding the distinction between limit orders and market orders is fundamental to making informed decisions and executing successful strategies. These two order types represent distinct approaches to buying or selling assets in financial markets.

Limit Order:

A limit order empowers the trader or investor to specify a particular price at which they are willing to buy or sell an asset. This order type provides a level of control, allowing users to predetermine the price at which they are willing to transact. The order will only be executed if the market reaches or surpasses the specified price point.

This strategy allows for careful planning and ensures that transactions occur at the desired price levels. However, there is the risk that the market may not reach the specified price, and the order may go unfilled.

Market Order:

In contrast, a market order is executed at the prevailing market price. It prioritizes immediacy over price specificity, making it quicker to execute trades. When a trader places a market order, they are essentially instructing the system to buy or sell the asset at the best available price in the market at that moment.

Market orders are suitable when speed is crucial, and the trader prioritizes swift execution over securing a specific price. However, it comes with the potential for slippage, where the final execution price may differ slightly from the expected price due to rapid market fluctuations.

Read more: Price Impact vs. Price Slippage in Liquidity Pools

Stay in the Loop with CrowdSwap

Jump in and discover the latest updates in the world of CrowdSwap's decentralized exchange

Conclusion

On CrowdSwap, you can exchange your tokens across different networks in two ways:

Limit Order and Market Order.

The choice between a limit order and a market order depends on the trader’s individual strategy, risk tolerance, and specific market conditions. Both order types offer unique advantages, and understanding their dynamics is essential for effectively navigating the complexities of financial markets.