The incredible growth of crypto-currencies lately had the world believe in the importance of investing in this wholly new and profitable world. The concern of financial risks has given its place to finding and choosing the best investment method. Whereas most investors need to gain specific knowledge about types of interests and how much money they can earn with less effort. Compound interest has helped many people meet their goals and exceed their financial targets. If you’re looking to maximize your financial gains, understanding how daily compound interest works is essential. In this comprehensive guide, we’ll explore the ins and outs of daily compound interest and how it aligns perfectly with Crowdswap, the decentralized exchange platform.

Read more about: What is a DEX? – CrowdSwap:

What does daily compound interest mean?

Let’s start at the beginning. Daily compound interest is a financial concept where the interest on your investments is calculated and added to your account balance daily. Unlike simple interest, which is calculated on the initial principal amount, compound interest considers both the principal and the accumulated interest. Moreover, daily compounding adds an extra layer of growth to your investments.

Simple vs Compound Interest

You expect to earn interest after depositing money into a financial system. Interests are divided into two main types. Simple and compound. To understand both concepts clearly, starting with a simple interest is a good idea.

Simple interest

How does daily compounding interest work?

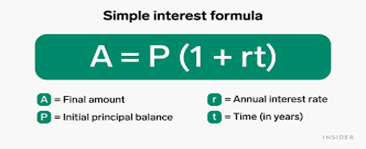

By the name itself, it is short and steady. Simple interest refers to the earned interest on the actual money deposited. Let’s discuss it through examples. If you invest $100 as the principal amount at the rate of 5% per year, by the end of the year, you have earned $5. It means it is calculated by multiplying the principal by the given rate. In this example, 100 multiplied by 5% equivalents 5. The critical point is that the original money invested stays fixed, and you will earn $5 each year. Take a look at this formula to learn how to calculate simple interest.

Compound interest

How does daily compounding interest work?

Contrary to simple interest, compound interest is not based on a fixed basis. Although it is a helpful method, the concept seems complicated to users. Learning the compound interest strategy is suitable for those who are aware of the constant pump and dump of the crypto market and are not easily fooled by the tricks of the whales. The only key to applying it is to be patient.

For example, consider a snowball. Suppose you are standing atop a snow hill, and a small snowball is in your hands. Now, a slight push is enough for this snowball to fall from the top of the mountain to the entire slope.

Along the way, the snowball gets bigger and bigger. By the time it reaches the ground, it has multiplied in size! In this example, if you rush to spend, you will get a small snowball or eventually double, but the passage of time and a lot of patience will reward the patient investors.

Compound Interest is calculated according to the principal and profits of the previous periods. For example, you enter cryptocurrency trading with $100 and add your monthly profit to the principal amount. Through this method, the profit from your property will increase exponentially. This investment method has a faster growth rate than simple interest. Simple interest is a fixed amount assigned to your initial amount invested, but compound interest accounts for your monthly profits and the principal. With this strategy, your investment will multiply in a few years.

Read more about How to Invest in DeFi – CrowdSwap

The Power of Daily Compounding: How It Boosts Your Savings

The key advantage of daily compounding is that it allows your investments to grow exponentially. As each day passes, your interest is recalculated based on the updated account balance. This compounding effect can lead to substantial wealth accumulation over time.

What does Compounded daily interest mean ? The importance of Time

Time is a critical factor when it comes to daily compound interest. The earlier you start investing, the more time your money has to grow. We’ll emphasize the importance of getting started as soon as possible to harness the full potential of daily compounding.

How to calculate compound interest?

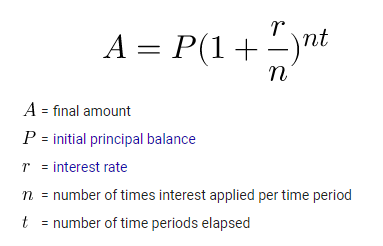

One of the common mistakes of traders is entering the crypto-currency trading market without sufficient knowledge and information. The growing interest in the crypto market and the introduction of new cryptocurrencies draw people’s attention to investing. But, when starting, these people forget the importance of investment strategies. A group enters this risky field with only their life capital, and another group buys a new cryptocurrency without knowing the market. Do not forget that calculating the rate of return on investment is one of the essential things a trader or investor interested in crypto should pay attention to. Here is the daily compound interest formula:

A = final amount

P = initial principal balance

r = interest rate

n = number of times interest applied per period

t = number of periods elapsed.

Let’s discuss it with an example. Suppose you deposit $10000 to the annual rate of 5%. According to this chart, after ten years, you will end up with around $15000. You can calculate your interest rate using the compound interest formula. The formula is as follows:

P = 10000

r = 5%

n = 1

t = 10

A = 10000 (1 + 0.05 / 1) (1× 10) = 16,288.95

| Course length | The amount of profit based on the rate of 5% | Profit calculation | Amount of capital Ultimate |

| First year | $500 | $10,500 | $10,000 x 5% |

| Second year | $525 | $11,025 | $10,500 x 5% |

| Third year | $551.25 | $11,576.25 | $11,025 x 5% |

| Fourth year | $578.81 | $12,155.06 | $11,576.25 x 5% |

| Fifth year | $607.75 | $12,762.82 | $12,155.06 x 5% |

| Sixth year | $638.14 | $13,400.96 | $12,762.82 x 5% |

| Seventh year | $670.05 | $14,071 | $13,400.96 x 5% |

| Eighth year | $703.55 | $14,774.55 | $14,071 x 5% |

| Ninth year | $738.73 | $15,513.28 | $14,774.55 x 5% |

| 10th year | $775.66 | $16,288.95 | $15,513.28 x 5% |

Compound Daily Interest and DeFi

To see how compound interest works with DeFi, consider staking crypto. As mentioned above, reinvesting the rewards rather than paying them out is the result. Every time you make a reward with tokens, put it back into the staking pool. The next time, you will start earning a profit on the initial principal deposited plus reinvested interests into the smart contract. Notably, since the staking profits are daily, you can increase compound interest daily. By the end of the year, you can gain more profit than you aimed to have with a simple interest-earning strategy.

Read more: What is DeFi? – CrowdSwap

Daily Compound Interest in CrowdSwap

Now, we all know earning compound interest is handy for users to apply. Since CrowdSwap concentrates on simplifying DeFi investments, we provide a built method to make a simple but desirable outcome for users. Through opportunities, service, compound profit (based on APY), and daily interest, explicitly defined, ready for you to choose your investing strategy.

Trade Effortlessly

Ready to dive deeper? Our crypto exchange is simple and user-friendly, making trading a breeze

You do the math!

Earning profit from crypto-currency trading has different strategies; each person desires to join this market. While traders are busy with short and long trades, intelligent and patient people make the most profit. Pay attention to the upward trend of the value in the last few years! Someone who has neglected his $1,000 profit has already pocketed millions in capital.