Introducing Easy Trade

Experience Simple, Instant, and Secure Trade across multiple blockchains with CrowdSwap decentralized exchange

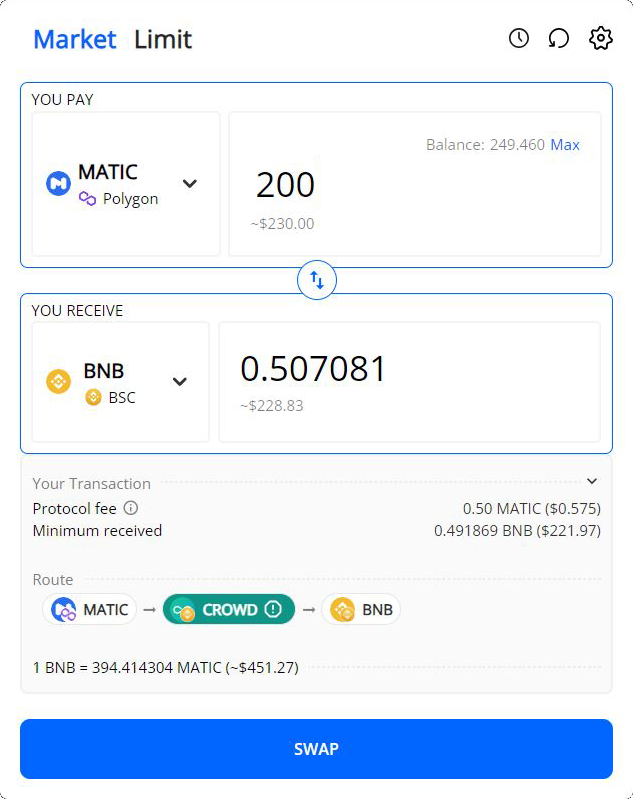

How to exchange tokens on CrowdSwap

A three-step process on the best crypto exchange that allows you to trade almost any token across multiple networks in the simplest design and fewest clicks. Just choose the token you have and the token you want, and we'll handle the rest!

Token Selection

Select tokens to sell and buy for your swap

Amount Entry

Enter the amount of token you want to pay

Transaction Confirmation

Connect your wallet, confirm and done! You can check the status of your trade on the transaction history tab

Top exchange pairs

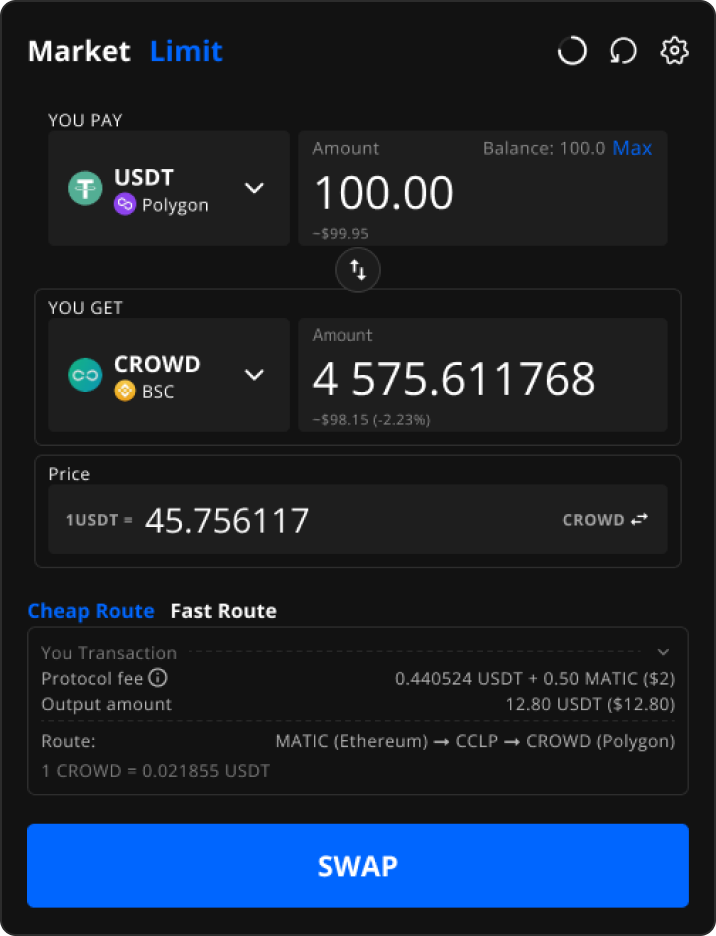

Enjoy cross-chain limit order

The Limit Order feature on CrowdSwap decentralized exchange allows users to specify the exact price and amount of tokens they want to buy or sell. A limit order only executes when the market conditions match your preferences. Some benefits are:

Control or skip market volatility and price fluctuations

Available on cross-chain transactions

Cancel the order if the market doesn't play for you

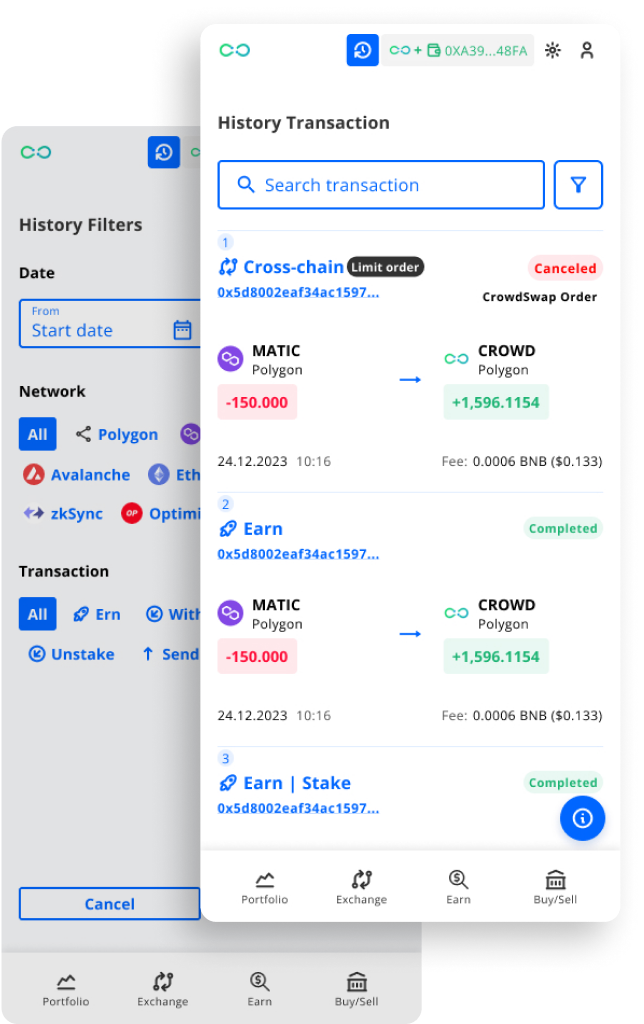

Seamlessly monitor and navigate your DeFi journey

Enhance your tracking with transaction history to:

Monitor transaction status

View all activities (exchanges, investments, staking) in a single dashboard

Utilize advanced filtering capabilities

Why CrowdSwap decentralized exchange

Simple and user-friendly process

Optimized design for easy and fast cross-chain swaps with fewer clicks. No wallet or network hassle. Just enter tokens and swap

Best Price Routing

CrowdSwap aggregator optimizes routes across DEXs for superior liquidity and pricing on your trades

Swap Quickly

CrowdSwap enables fast and secure swap and cross-chain transactions, allowing you to transfer tokens between different blockchain networks in no time!

Cross-Chain Any to Any

Unrestricted swapping: Bridge and exchange any token across chains!

Fee Transparency

CrowdSwap decentralized crypto exchange shows you the exact fees for each transaction. No hidden costs, only clear breakdowns

Cross-Chain Limit Order

Maximize trading efficiency and minimize losses with cross-chain limit orders. Set limit orders directly across networks, eliminating the need to bridge crypto between blockchains and reducing risk

Buy CROWD and enjoy flexible rewards on staking

CROWD staking opportunities are available on several networks, including Polygon, BSC, Avalanche, and zkSync networks

Don’t have a wallet yet?

If you are new to DeFi, we will guide you in learning about every detail

Don’t have any tokens in your wallet?

By using CrowdSwap fiat to crypto service, you can easily buy tokens with your bank account or credit card

Frequently Asked Questions

Cross-chain refers to the capability of transferring tokens between various blockchain networks.

Read more: “What Are Cross Chain Swaps?”

For example, using a cross-chain feature on a decentralized exchange, you could seamlessly swap Ethereum-based tokens like USDT (ERC-20) with tokens native to the Binance Smart Chain (BSC), such as BUSD (BEP-20)

The transaction fee consists of:

- Network cost

- Protocol fee

- Flat fee: A fixed fee in the source network’s coin.

- Execution cost: The execution cost pertains to the expenses incurred during transaction execution on the destination network, including variables like gas price and the network’s coin price.

- CrowdSwap fee: This fee goes to CrowdSwap treasury, from 0.5% to 1% of the exchange amount.

Slippage is the difference between the expected price of a trade and the actual price executed. Slippage can occur due to market volatility, liquidity, or network congestion. You can set your slippage tolerance on CrowdSwap DeFi exchange by adjusting the percentage slider or entering a custom value. The higher the slippage tolerance, the more likely your trade will go through, but the worse the price you will get

You can view your transaction history on CrowdSwap decentralized exchange by clicking on the “History” tab in the top right corner of the interface. You will see a list of your past transactions, along with their status, network, tokens, amount, and date. You can also click on each transaction to see more details, such as the transaction hash, gas fee, and DEX route

Want to know more?

Subscribe to our newsletter to get the latest opportunities and education blogs