BYOB does not stand for the well-known “Bring your own beer,” although it would certainly fit into approaches. It’s called “Be your own bank.” This is the concept of being responsible for your financial capital and not relying on third-party financial institutions to manage your money. Especially in recent months, some central providers of financial services have faltered and had to file for bankruptcy. So the question arises more and more: Where is the way out of this dilemma? This article explores the benefits and challenges of BYOB and its relationship to the emerging area of the decentralized financial system (DeFi).

The Bankruptcy of FTX

Our story begins with the recent bankruptcy of FTX. This popular crypto derivatives exchange has also exposed the limitations of the traditional financial system. As a manager of funds, certificates or a banking license is required in this country to offer these services.

FTX was one of these centralized providers to which many investors entrusted their money. FTX behaved in internal business and got into trouble when the crypto market collapsed, resulting in huge losses for many private investors.

This case illustrates the risks of relying on intermediaries to manage financial assets. The traditional financial system is based on trust, where individuals deposit their funds with third parties such as banks, stockbrokers, and stock exchanges. However, as we’ve seen with FTX, this system isn’t foolproof and can be littered with bugs and vulnerabilities.

Future of Money

“Future of Payment” rapidly moves from cash to digital money. With the advent of mobile payment and e-commerce, we are already moving towards a cashless society, and this trend will continue. Digital currencies such as Bitcoin and other cryptocurrencies are becoming increasingly popular l as alternatives to traditional fiat currencies.

One of the main advantages of digital money is convenience. Digital money enables quick and easy transactions without physical money or card payments. This ease of use is driving the adoption of digital payments. In addition, digital money is safer than cash because fraud can be easily tracked and monitored.

However, some challenges still need to be addressed to realize the full potential of digital money. For example, interoperability between different payment systems and currencies must be improved. In addition, digital payment methods can be vulnerable to cyberattacks, prompting robust security measures to develop. The DeFi sector mainly shows possibilities to solve these challenges.

DeFi and the Rise of Smart Contracts

Decentralized Finance (DeFi) is a new financial system built on the principles of blockchain technology. DeFi harnesses the power of smart contracts to eliminate the need for intermediaries and enable users to transact directly with each other. This system does not require an approval process. Anyone can participate without intermediaries or third parties.

“One component of trust building is a smart contract that establishes a transaction between the service provider and the contract terms.”

The DeFi room has exploded in recent years. Many platforms offer financial services such as lending, borrowing, and trading. However, despite the potential benefits of DeFi, many users still need to be convinced to adopt the technology. One of the reasons is the lack of security, trust, and ease of use in the DeFi ecosystem.

Improve DeFi Security, Trust, and Usability.

Security is one of any financial system’s most critical elements, especially in DeFi. The lack of intermediary systems makes every smart contract more vulnerable to hacking, phishing, and other cyber attacks. Therefore, it is essential to implement reliable security measures to protect funds and personal data.

Another important factor is confidence in the financial system. Trust is built through regulatory oversight, insurance, and other mechanisms. In the DeFi space, trust is built through smart contracts and code audits. However, it is imperative to ensure that smart contracts are secure and free of vulnerabilities.

User-friendliness completes the group of necessary prerequisites in the DeFi area. While permissionless and trusted transactions are appealing, the transaction process in DeFi can be complex and challenging for non-technical users. Therefore, developing user-friendly interfaces and tools that simplify DeFi platform use is crucial.

Fast Lane Transactions with CrowdSwap

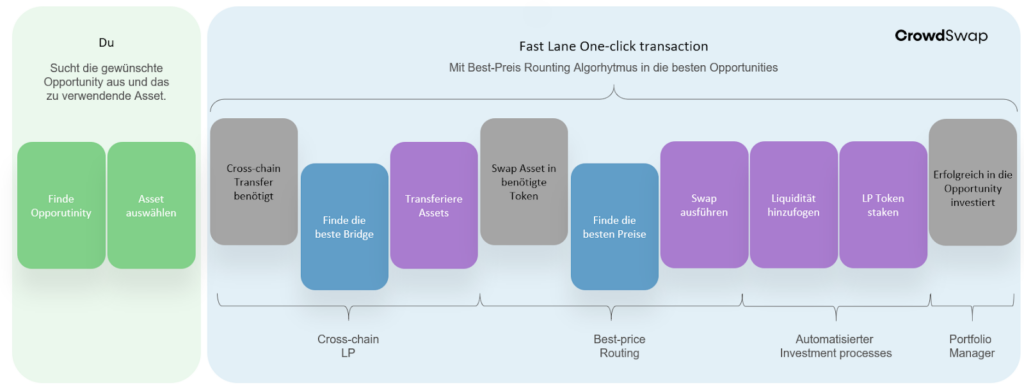

One solution to improve user experience in DeFi is Fast Lane Transactions. Fast Lane Transactions bundle multiple transactions into a single executable transaction, reducing the number of steps required to complete a transaction. This approach simplifies the process, reduces the risk of error, and makes it easier to use.

Source: CrowdSwap

How Does CrowdSwap Fit Into The BYOB Narrative?

CrowdSwap is a DeFI platform that offers fast-lane transactions. The platform allows users to exchange tokens quickly and efficiently at the best prices in the market. CrowdSwap utilizes crosschain technology to enable users to transfer tokens seamlessly between blockchain networks.

In summary, BYOB emphasizes “Personal Responsibleness” over financial capital and breaking off from the intermediary financial instruments.

For this purpose, the DeFi sector is a suitable candidate as it contains all the financial products required to form the basis for BYOB.

“The barriers alone are currently still too high for mass use.”

DeFi and Fast Lane Transactions are promising solutions to the shortcomings of the traditional financial system. However, to realize the full potential of DeFi, platforms must focus on improving security, reliability, and usability. They should focus on creating easy-to-use interfaces and tools that make it easier to use DeFi protocols. Suppose the barriers to entry in DeFi can be lowered. In that case, this decentralized financial market faces many users already finding better investment opportunities than traditional financial products.

Trade Effortlessly

Ready to dive deeper? Our crypto exchange is simple and user-friendly, making trading a breeze

Shortly:

This article explores the benefits and challenges of BYOB and its relationship to the emerging decentralized financial system (DeFi) area. We examine current crypto market developments and explore the DeFi sector’s trilemma. Is DeFi ready to replace the traditional financial system?