As the name speaks for itself, a liquidity pool is a pool of tokens locked in a smart contract. It facilitates transactions in a DeFi protocol. In addition, it is widely used by some decentralized exchanges, increasing market liquidity among market participants. Follow this article to find out.

What is a liquidity pool?

Liquidity pools are generally very similar to pooled funds that existed long before now. Simply put, it is like a reservoir formed by pooling funds together. Liquidity pools are the same, except they have become popular with the advent of the decentralized finance (DeFi) ecosystem.

The fact that liquidity is so important is that it largely determines how asset prices change. In illiquid markets, a relatively limited number of open orders are on all sides of the order book. This shows that one trade can move the price substantially in any direction, making the market unpredictable and unattractive. Liquidity pools are essential to the DeFi revolution and have enormous potential. Typically, these pools facilitate the exchange of many assets for any other supported asset.

If you have used a cryptocurrency trading platform, you should know that the platform’s transaction is based on the order model, just like traditional stock markets like NYSE and NASDAQ. In these order-based markets, buyers and sellers each place an order. Buyers want to buy the desired asset at the lowest price, while sellers want to sell the same asset at the highest price. Therefore, buyers and sellers must agree on a fee if a deal is to be struck. Two things can happen in a transaction: the buyer raises his bid, and the seller sells at a lower price.

But what if no one else is willing to bid again? Or what if you don’t have enough money to place a buy order? At this time, it is necessary to rely on the participation of market makers. Simply put, a market maker is an entity that facilitates transactions, always taking buy and sell orders, thus providing liquidity. Therefore, users can conduct transactions without waiting for a counterparty to appear.

But market making in the DeFi world is slow, expensive, and hard to use, but without market makers, an exchange would immediately become illiquid. That’s why now is the time to invent something new to make it work more smoothly in a decentralized world. This is why liquidity pools are needed.

How does the liquidity pool work?

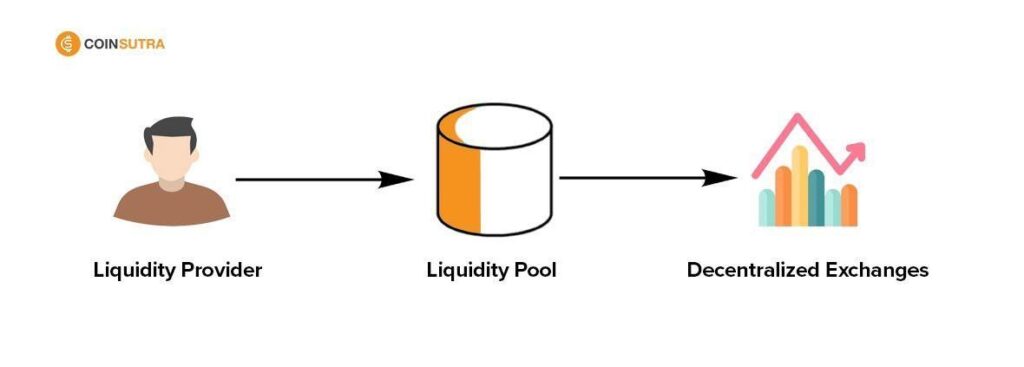

Generally speaking, a liquidity pool will have two tokens, and these two tokens form a new market transaction. When a new liquidity pool is created, the first liquidity provider (LP) will set the initial price in the pool, and that LP will be driven to maintain the same value for both assets in the pool.

Photo credit: coinsutra

When the liquidity pool obtains liquidity (understood as a capital injection), it will get a unique LP token representing the liquidity ratio they provide. When this liquidity pool facilitates transactions, 0.3% of transaction costs will be distributed proportionally to all LP token holders. If LPs want to withdraw the liquidity they provided, the LP tokens they represent must be burnt.

Every time LP tokens are burnt, a price adjustment is initiated based on a deterministic algorithm, the Automated Market Maker (AMM). The basic liquidity pool uses a constant commodity market maker algorithm, meaning the amount of two tokens remains constant. On top of that, due to the algorithm, the pool will still be liquid regardless of the volume. The main reason is that the algorithm asymptotically increases the token’s price as the target amount increases.

Some protocols, like Balancer, give LPs more incentives to attract liquidity. This process is called liquidity mining. The concepts of liquidity pools and automated market makers are simple yet valuable. We don’t need external support from market makers if we don’t have a centralized order book.

Introducing Yield Farming Opportunities:

CrowdSwap is adding new yield farming programs for various chains. So far, users have been able to farm on Polygon and BSC networks. Each of these blockchains has different options, to which new ones are being added as the system updates. To date, the following pools are accessible on CrowdSwap:

Participating in these pools is done on CrowdSwap with easy steps everyone can follow. The exciting thing about yield farming options on CrowdSwap is that with the cross-chain technology, holders of assets from other chains can participate in these programs. This means you don’t need to swap your existing tokens to the LP pair before investing. Check these outstanding features, and a lot more, by visiting the ‘OPPORTUNITIES’ section of the CrowdSwap App.

How much can you make with liquidity pools?

Yield farming or liquidity mining, is the practice of lending your tokens to a DeFi protocol and receiving rewards in return. Because the reward is often paid in the form of the platform’s native token, the token’s price directly affects your profit. Therefore, how much you can make depends on the price of that cryptocurrency.

Read more about: what is yield farming?

What is Liquidity pool mining and liquidity Defi mining?

Liquidity mining allows the project to reward users for depositing large amounts of their funds into a pool and trading the asset, offering exchange liquidity for a token reward. The reward can be in any form, from tokens to points, to a percentage of the trading fees generated. The concept is similar to staking in that users can earn rewards in exchange for locking up their funds. This allows users to be rewarded without having to exit the market and increases the overall liquidity of the asset, which benefits everyone in the ecosystem.

Liquidity Defi mining is a protocol-level system for incentivizing users to increase the liquidity of a given asset. The concept incentivizes users to supply tokens to a liquidity pool. The rewards from Liquidity Defi mining are typically in the form of rewards tokens which can then be used to earn further rewards from the system. Liquidity Defi mining aims to generate More liquidity in the ecosystem, creating a more competitive market and increasing the asset’s value.

What is the role of the crypto liquidity pool in Defi?

Crypto Liquidity Pools are gaining more and more popularity as decentralized finance (DeFi) continues to grow in leaps and bounds. As decentralized financial protocols become increasingly complicated and complex, it has become necessary for different pieces of the DeFi puzzle to

Exist, such as Liquidity Pools. As opposed to centralized exchanges, Liquidity Pools are decentralized, automated exchanges that are built on Ethereum-based smart contracts, with no single entity in charge. Crypto

Liquidity Pools play a critical role in DeFi by providing liquidity to trading markets. This ensures an exchange has endless buyers and sellers, enabling it to remain active, efficient, and safe.

By providing liquidity to trading markets, liquidity pools are a crucial component of the DeFi ecosystem. They help increase trading volumes and make it easier for people to trade on the platform.

Liquidity pools also help protect against price manipulation, ensuring a reliable market for buyers and sellers to trade in. This prevents any single party from taking control of the market and ensures that prices remain stable, reliable, and fair for everyone involved. Liquidity Pools are also often used to support the growth of decentralized applications, as they can provide needed liquidity on exchanges for developers to expand and improve the platform’s services.

Crypto Liquidity Pools can also be used to increase user adoption and engagement on DeFi platformsLiquidity Pools can reduce volatility and increase user trust in the platform by offering users more access to diverse trading options. This leads to increased user engagement, demand for certain digital assets, and larger and more liquid markets.

In conclusion, Crypto Liquidity Pools have become an essential part of the DeFi ecosystem, providing crucial liquidity to trading markets and helping to protect against price manipulation. They can also help to increase user adoption and engagement and support decentralized application development. As the DeFi space grows, Crypto Liquidity Pools will remain an integral part of the landscape.

Why are crypto liquidity pools Important?

Crypto liquidity pools are essential because they provide the crypto market with an easy, convenient, and cost-effective way to facilitate smoother and faster transactions, allowing users to exchange coins quickly without directly negotiating their trades. Liquidity pools enable buyers and sellers on different exchanges to trade with each other, thus providing a more efficient way to move coins from one exchange to another. By increasing the efficiency of trades, liquidity pools help to stabilize the crypto market by reducing volatility. They also help to ensure that transactions are completed quickly, at the lowest costs, and with greater security.

The risks of liquidity pools:

They allow exchanges to quickly buy and sell cryptocurrencies and maintain a steady flow of trading capital. However, liquidity pools also pose a risk because markets become vulnerable to specific security weaknesses.

The primary risk of a liquidity pool is that a hacker may be able to compromise the system. Such risks arise due to the centralized architecture of liquidity pools. An attacker could exploit this design loophole to access the private keys used to manage funds or to manipulate the order book transactions. This could lead to significant losses as the funds held in the liquidity pool would be at risk of being stolen.

Another risk associated with liquidity pools is wash trading. This occurs when traders attempt to manipulate the market by creating artificial demand for digital assets. For example, a sell-side trader will place a large buy order at market price and a small sell order at a discounted price. This may cause the asset’s price to rise drastically and price manipulation. The best way to mitigate these risks is to employ a decentralized exchange or DEX protocol. A DEX protocol utilizes smart contracts to execute trades securely in a trustless environment. This ensures traders are not subjected to the risks associated with centralized exchanges, such as liquidity pools.

In addition, it is vital to ensure that liquidity pools are properly managed

and audited. This means regular checks should ensure that all funds are safe and that the order book data is accurate. Additionally, funds should not be placed with a single service provider, and it is important to diversify the asset holdings among multiple liquidity providers.

Finally, it is essential to maintain a vigilant security posture. This means continual network monitoring for changes or irregularities in the transaction ledger. By following these measures, the risks of liquidity pools can be significantly reduced.

Read more about: what is a Dex?

What is the purpose of a liquidity pool?

The liquidity pool is an important tool for the modern cryptocurrency exchange. It transparently ensures the smooth buying and selling of digital assets, thus providing essential liquidity, which helps simplify and faster the trading process.

A liquidity pool is created by providing an equal mixture of two or more digital assets, usually from different exchanges. This pool is open to market participants and provides a way for traders to purchase digital assets from the pool and also sell them. The liquidity pool also works to match buyers And sellers, ensuring that there is always a sufficient number of buyers and sellers for each asset in the pool.

A liquidity pool aims to provide a steady flow of buyers and sellers in the cryptocurrency exchange, thus helping to fuel liquidity. The liquidity pool maintains stability. Ultimately, a liquidity pool provides a convenient and secure market for buyers and sellers to trade digital assets safely and quickly. This helps to protect the market’s stability and ensure that prices remain consistent.

Pros and cons of liquidity pools:

Pros:

1. Increased liquidity:

One of the main advantages of liquidity pools is increased liquidity. With more money floating around, buyers and sellers on the exchange have more options and can execute their trades faster. This can help traders take advantage of market movements more effectively.

2. Reduced spreads:

Because of the increased liquidity, the spread of prices between bids and asks can be reduced. For example, if less money is floating around, the ask and the bid prices can be far apart. A wide bid-ask spread means that traders have to pay a higher price when buying and receive a lower price when selling, which increases their transaction costs. But with a liquidity pool, there is more money, meaning traders pay less for their trades.

3. Reduces counterparty risk:

Because of the increased liquidity on the exchange, there is less chance of one party defaulting on their trade. This benefits the exchange because it reduces the risk that the exchange will need to cover the losses of the defaulting party.

Cons:

1. Exchange fees:

Some exchanges charge hefty fees when withdrawing from the liquidity pool. This is especially true of decentralized exchanges, which may have high withdrawal fees. This means traders must be aware of the costs they must pay when taking assets out of the liquidity pool.

2. Disparity in price:

Some exchanges use liquidity pools to set a unified market price, meaning there will be a discrepancy between the bid price and the ask price paid by buyers and sellers. This can benefit the exchange, as they will pocket the difference, but it’s not ideal for traders.

3. Risk of instability:

Because the exchange can control the liquidity pool, they could theoretically manipulate the prices in the market. This is risky for traders, as it could lead to unexpected price swings and instability in the market.

Overall, liquidity pools can be a great way to improve exchange liquidity, but it’s essential to understand the associated risks. Research a particular exchange’s fees, prices, and risks before diving in.

Yield Farming vs. Liquidity mining vs. Staking: What’s the Difference?

As the cryptocurrency market continues to mature, investors have more options than ever when looking for a way to earn income from their assets. From staking coins to providing liquidity for markets, there are many different ways to create passive income. But what’s the difference between yield farming, liquidity, and staking? Let’s look at these three different income-generating methods in more detail.

Yield Farming

This is a newer income generation method for cryptocurrency investors and aims to maximize the return on capital by taking advantage of DeFi protocols. Through yield farming, investors deposit liquidity into DeFi protocols to provide access to the liquidity pool. This earns them interest and rewards, which they can reinvest in the same or other DeFi projects. Yield farming can be a more complex approach to earning income and involve more risk than other methods, so it is not recommended for beginner investors.

Liquidity mining

Providing liquidity for markets can be a great way to earn income through cryptocurrency, as it involves less complexity and usually less risk than yield farming. Liquidity providers can earn income by buying and selling Cryptocurrencies, and the more they trade, the more money they can make. This is often done through liquidity pools such as Uniswap, where liquidity providers put up tokens to provide liquidity for the system. In exchange, they are rewarded with fees from trades that occur.

Staking

is one of the most popular methods of generating income through cryptocurrency, as it does not involve much risk and has a good potential for reward. Staking involves possessing a certain amount of cryptocurrency to process transactions, acting as a “ validator” for the blockchain. This earns the staked digital asset holders a share of the network’s rewards every time a new block is added to the blockchain. This method can be quite lucrative and is an excellent way for long-term investors to build up passive income.

when it comes to earning from your cryptocurrency investments. Yield farming, liquidity, and staking offer potential for passive income but come with different levels of complexity and risk.

Yield farming can be the most profitable but is not recommended for beginners, whereas staking is a safer and easier way to earn income without too much risk. When choosing between these three methods, it’s important to consider your own risk appetite, investment

goals, and current knowledge of the cryptocurrency market and any associated technology.

Read more: What is staking crypto? – CrowdSwap

Forecast for the future of liquidity pools:

It is hard to predict the future of liquidity pools in DeFi, as the industry is still in its early stages. However, the likely outcome is that the liquidity pools will continue to grow in popularity and size as people flock to DeFi protocols and services. We can also expect to see more decentralized exchanges and DeFi protocols created and more research and development in the space. There is a high potential for liquidity pools to continue to provide increased liquidity, low trading fees, and fast transaction speeds for users.

Are liquidity pools safe?

Everyone’s financial situation is unique, and the need for liquidity often varies. But for many, maximizing liquidity is a priority to ensure their secure future. Increasingly, people seek liquidity options beyond traditional banks and investments, including liquidity pools. So are liquidity pools safe?

Liquidity pools are collective investments or groups of assets acting as one. They provide liquidity either through their cash or from other parties, such as hedge funds and investment banks. The key with liquidity pools is that they can offer rapid access to money if needed, making them an excellent option for those who want quick access to funds if the need arises.

One of the advantages of liquidity pools is that regulators closely monitor them. Since liquidity pools involve various investments, regulators ensure that the investment portfolio is managed responsibly and that no red flags appear. This provides a layer of extra security not present in non-regulated assets.

Another advantage of liquidity pools is that they are generally low-risk investments.

The funds invested in liquidity pools are often very diverse, so the risk of losing all the money is significantly reduced.

Overall, liquidity pools allow investors to maximize their liquidity and gain access to fast cash if needed while maintaining a relatively low-risk portfolio. The combination of regulatory oversight and diversification of investments makes liquidity pools generally a safe option for maximizing liquidity.

Trade Effortlessly

Ready to dive deeper? Our crypto exchange is simple and user-friendly, making trading a breeze

Conclusion:

Participation in liquidity pools is one of the ways to earn passive income during the bearish market, and it is the go-to choice of many cryptocurrency market investors. Learning how it works is essential to calculate your potential profit and loss (PNL). In this article, we tried to explain a liquidity pool and how it works in simple terms.

Faq:

What is the main effect of the liquidity pool in cryptocurrency exchanges?

It ensures the smooth buying and selling of digital assets and helps to simplify and faster the trading process.

What will be the future of the liquidity pool?

There is a high potential for liquidity pools to continue to provide increased liquidity, low trading fees, and fast transaction speeds for users in the future.

What makes the liquidity pool a safe palace for investment?

The combination of regulatory oversight and diversification of investments makes liquidity pools generally a safe option for maximizing liquidity.