Meet Your DeFi Demands: Simplified Solutions for Complex Challenges

Our products are for everyone - whether you're exploring DeFi for yourself or looking for solutions for your business. We make things easy to use, helping you or your business thrive in the DeFi world. Explore our products today and see how we can simplify your DeFi journey.

Experience the Future of Web3 wallets with CrowdWallet!

Dive into the future of digital wallets with our Web3 Smart Wallet. It effortlessly handles private keys, offering you a worry-free and simplified experience.

Exchange

CrowdSwap lets you exchange crypto tokens for the best value. Trade any altcoin fast, easy, and safe. See the best prices and fees from 30+ exchanges, set your own price with our advanced limit order and monitor your exchange history with our app

Exchange

Why CrowdSwap Exchange?

Introducing our revolutionary exchange function, designed to redefine your DeFi experience with its exceptional capabilities. Explore the future of DeFi with us—where innovation meets simplicity

CROWD The Heart of CrowdSwap

CROWD is our native utility token, designed to provide users with a seamless experience on CrowdSwap. It’s more than just a token - it’s an integral part of our ecosystem.

CrowdSwap telegram bot

Say goodbye to the complexities of private keys with CROWD’s Web3 Smart Wallet! Join our Telegram Bot and start exchanging with our bot today!

Effortlessly swap any token across different chains. Our platform’s cross-chain functionality ensures you’re not limited by boundaries, making every transaction as fluid as possible

Our simple interface lets you quickly find prices and pick tokens on any blockchain with fewer clicks to the goal

No hidden costs—our detailed fee breakdown ensures you know exactly what you’re paying for, providing clarity and trust in every transaction

On most DeFi platforms, you may be asked to switch networks to look around without making any real transactions. Our platform makes things easier for you by only asking for a network change when you’re about to finalize a transaction. This means you can explore and plan your trades without constant interruptions, leading to a smoother and more user-friendly experience

As an aggregator, we scour dozens of DEXs to guarantee the best prices for your transactions. Our technology ensures you always get the most value from your swaps and bridges

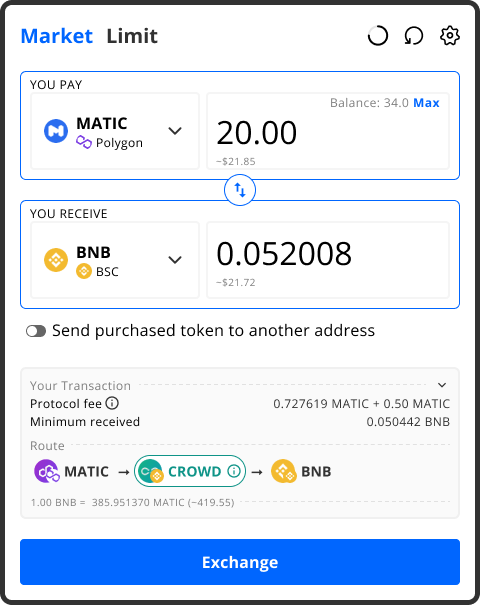

Our unique feature lets you easily set orders across blockchains—like selling MATIC for BNB when prices hit your target, without the hassle of multiple steps to bring your asset first to the BNB chain. It reduces the risk of loss since you don’t need to sell your MATIC first on Polygon. Straightforward and efficient, it creates more chances for profit with less effort

Our cross-chain swap feature taps into CROWD’s power to offer you the best platform rates. This smart approach guarantees more value and efficiency in your transactions, simplifying your swap process while maximizing benefits

Exchange

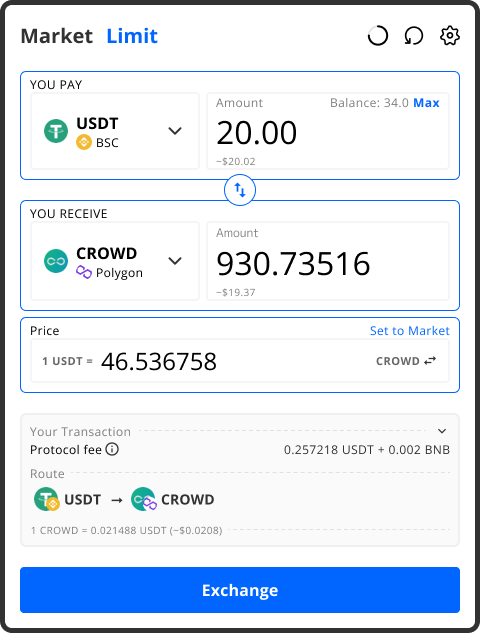

Limit Order

CrowdSwap Limit Order feature lets you set the price and amount of tokens you want to trade, and your order executes when the market conditions match your preferences

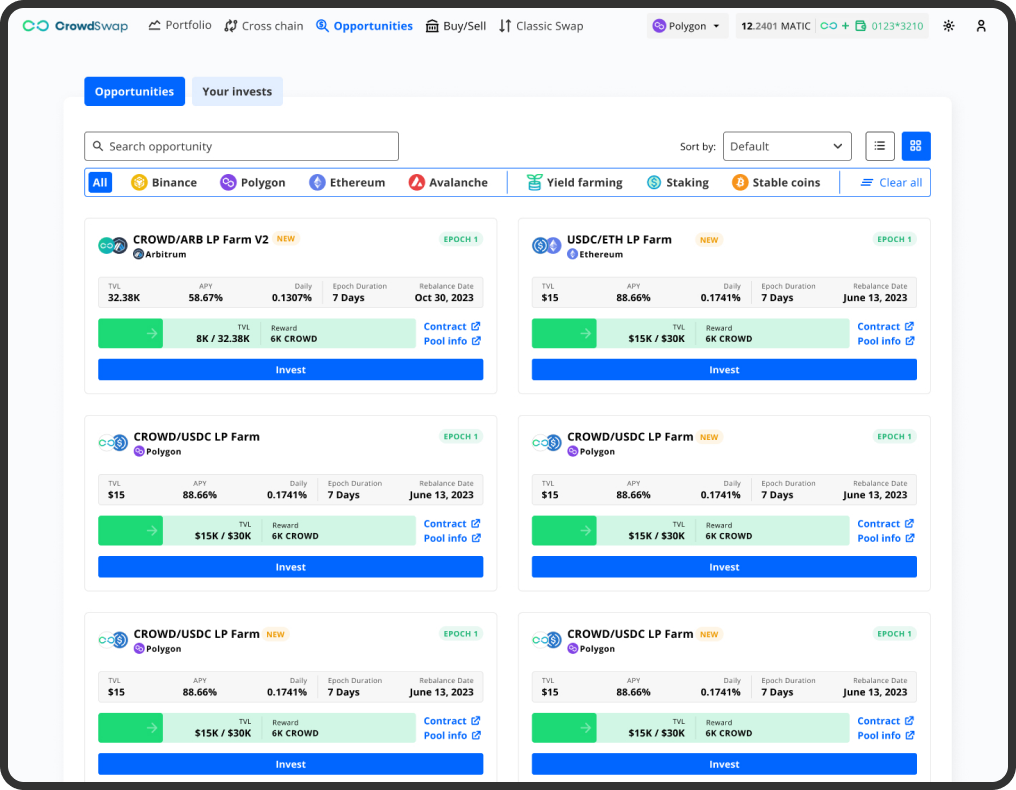

Empowering Your Crypto Investments

At CrowdSwap, we believe in making your crypto work for you. For that, we made DeFi easy for even newbies!

Whether you choose to stake, provide liquidity, or invest in our DeFi ETF, you can watch your investments grow.

Earn

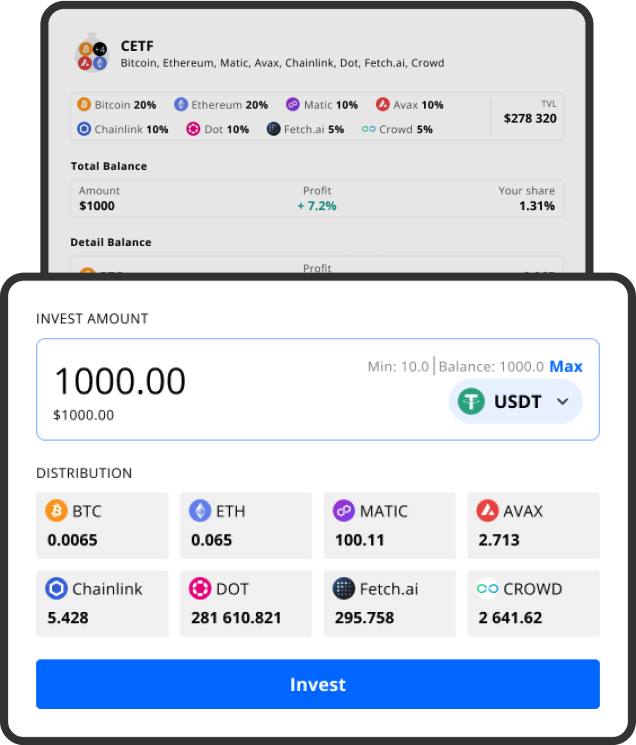

The First-ever ETF on DeFi

CrowdSwap ETFs are collections of selected tokens you can acquire in one transaction rather than purchasing each separately on different blockchains.

Earn

Simplifying Liquidity Pool Farming for Users

In the conventional DeFi ecosystem, participating in the liquidity pools can often be complex and frustrating, especially when you're looking to invest in a specific pool, such as Matic/USDC, but only hold one type of token. Let's break down the typical issues and how CrowdSwap addresses them

Earn

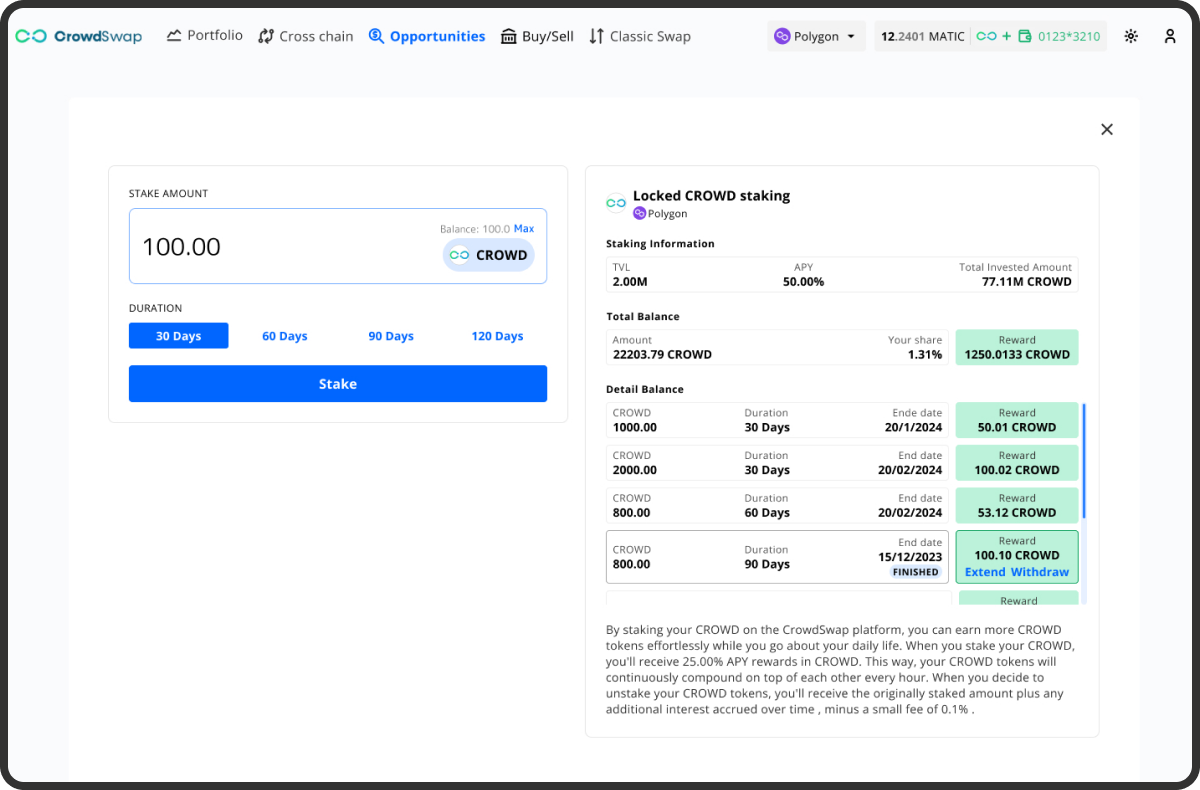

Staking

The staking feature enables users to grow their valued holdings. By staking CROWD or other available tokens, users can earn rewards. Rather than merely holding, it's more beneficial to stake your tokens and watch them multiply.

CrowdSwap offers two ways of staking in its app:

Standard and locked. Standard staking lets you withdraw your tokens at any time you wish, while locked staking gives you higher rewards but requires you to lock your tokens for a certain time. You can choose the option that suits your needs and preferences.

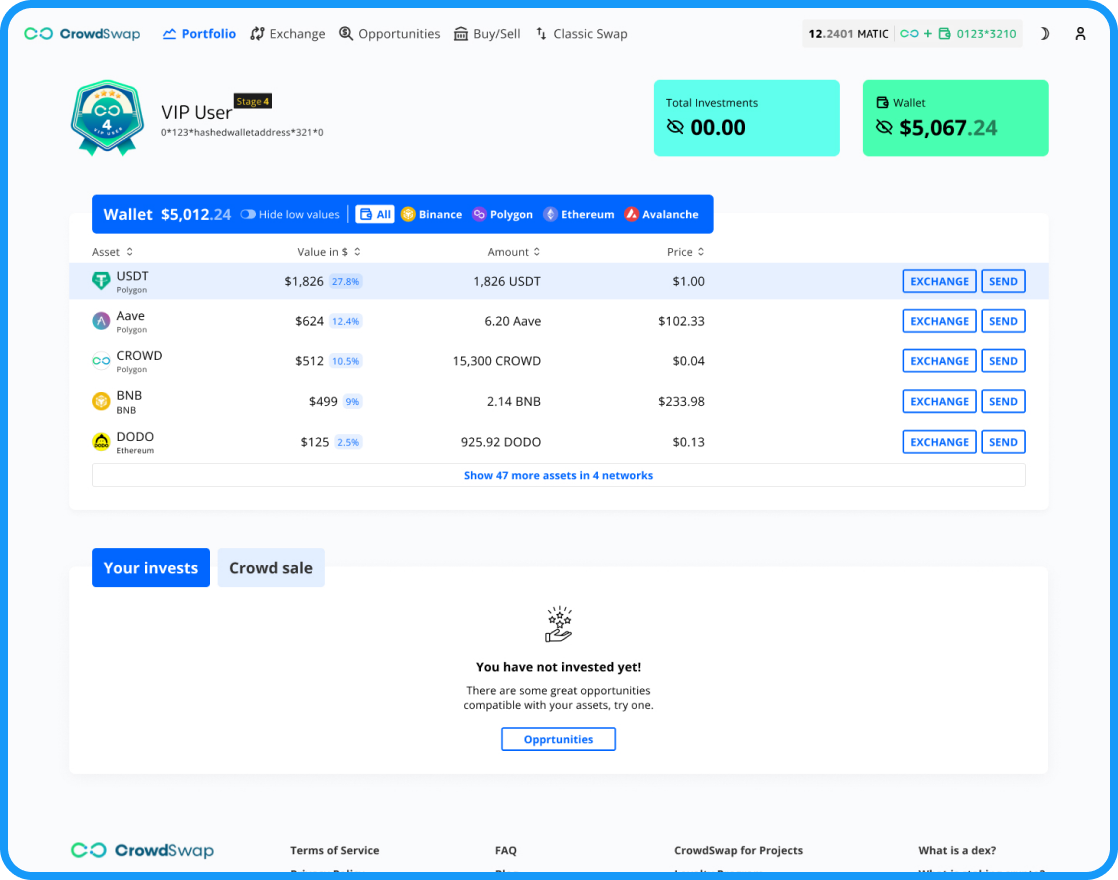

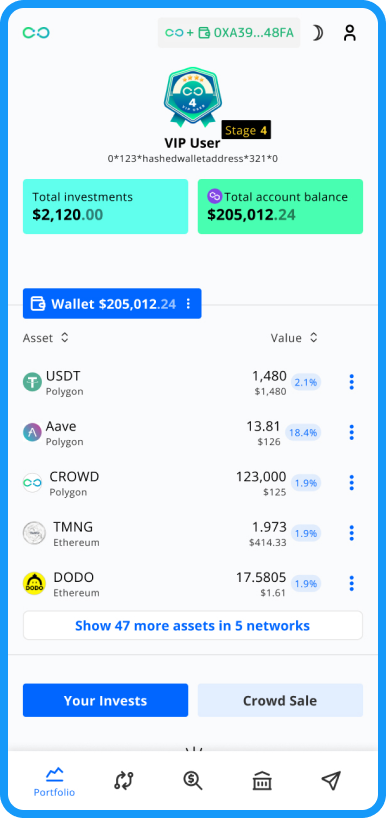

Portfolio Manager

Seamlessly view and manage all your assets and investments across multiple blockchains in one intuitive interface. Enjoy the following features

Portfolio Manager

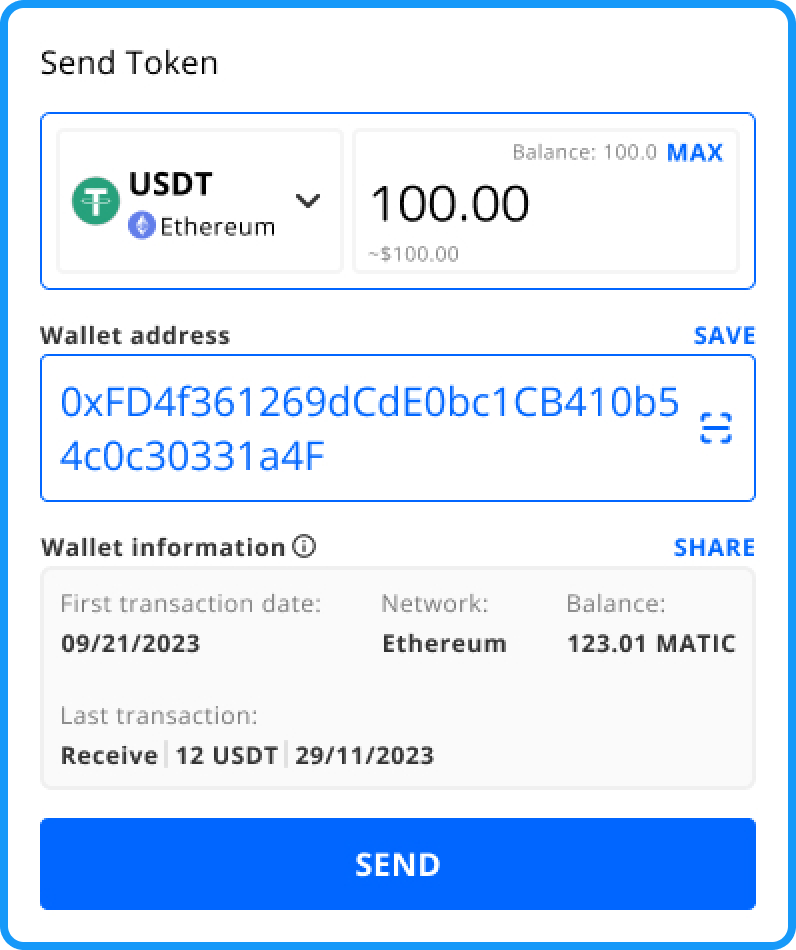

Token Transfer

CrowdSwap always puts security first. Our new crypto transfer feature helps you avoid many security threats. By using the crypto transfer feature on the portfolio page, you will see the details of the recipient’s wallet, such as the first and last transactions, the network, and the balance. You can use this information to verify your wallet and prevent errors or scams.

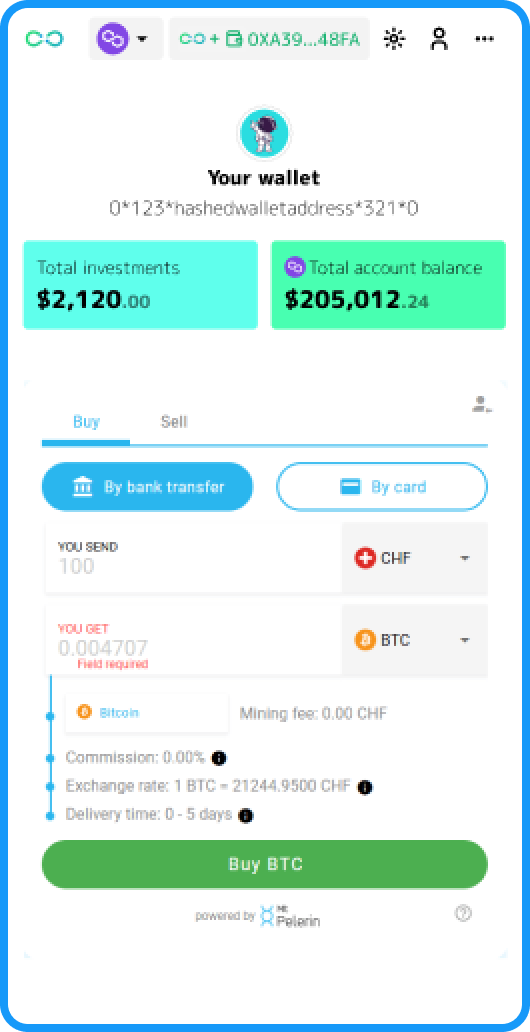

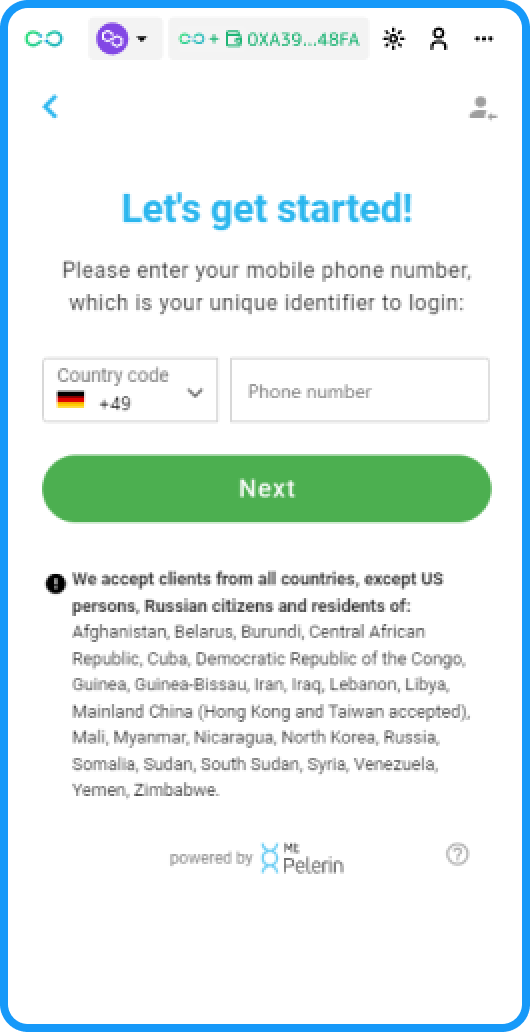

Fiat to Crypto Exchange

Are you looking for a fast, easy, and secure way to swap your fiat currency for cryptocurrencies? If so, you’ll love the buy-and-sell crypto feature from CrowdSwap: fiat to crypto exchange. With fiat to crypto exchange, you can use your credit card or bank account to buy or sell any of the supported coins on CrowdSwap, such as Bitcoin, Ethereum, Litecoin, and more. You don’t need to create an account or verify your identity. Just enter the amount you want to swap, choose your payment method, and confirm the transaction. It’s that simple. Fiat to crypto exchange is the ultimate solution for anyone who wants to get into the crypto world without hassle.

Designed and developed by Smart Chains. Operated by Smart Defi

Copyright 2024 CrowdSwap. All rights reserved

Subscribe for CrowdSwap Updates & Offers! ✉