The rise of Decentralized Finance (Defi) has brought about a new era of innovation and opportunity in the world of cryptocurrency. One of the critical challenges of DeFi is finding the best prices and liquidity for trades across multiple decentralized exchanges (DEXes). This is where DEX aggregators, also known as decentralized exchange aggregators, come in.

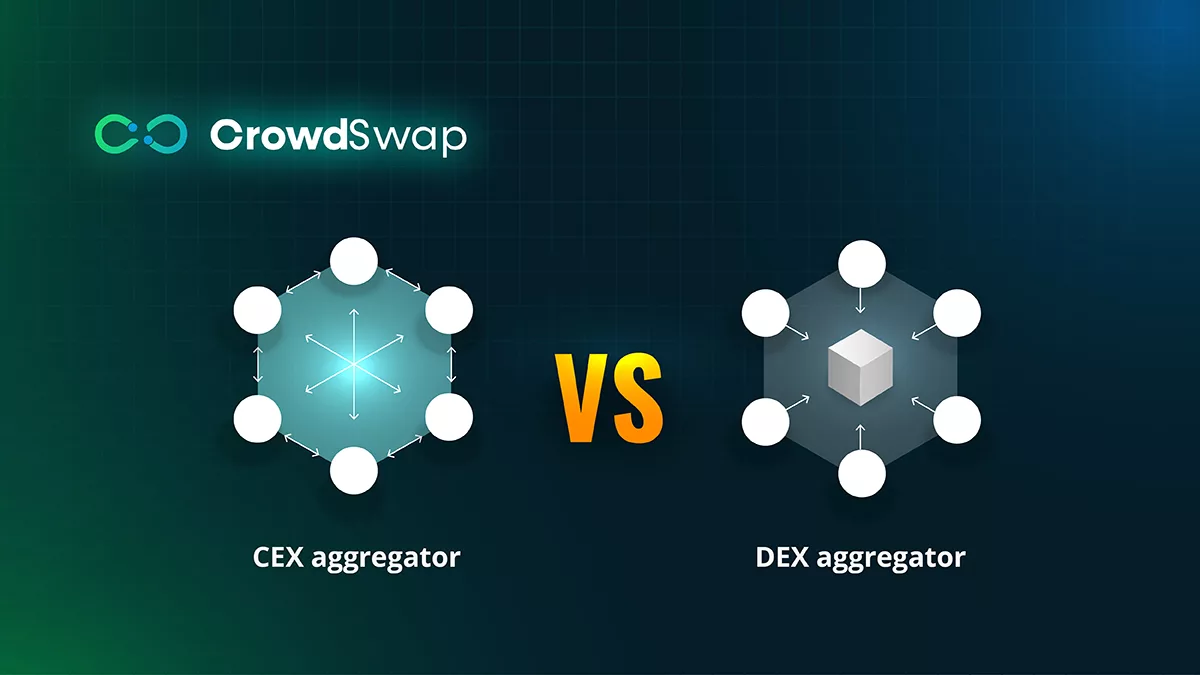

Exchange aggregators are platforms that allow users to access multiple exchanges and find the best prices and liquidity for their trades. There are two types of exchange aggregators: DEX and CEX. This article will explore the differences between these two types of aggregators and help you decide which one is right for you.

DEX aggregators and CEX aggregators are both types of cryptocurrency exchange aggregators. Still, they differ in the kinds of exchanges they aggregate. Essentially, DeFi frequently relies on DEX (Decentralized Exchange) aggregators.

Read more about what aggregators are and how they work.

What Are DEX Aggregators?

DEX aggregators connect to multiple decentralized exchanges and provide users with access to their liquidity pools and order books. These tools gather, analyze, and utilize smart contract data from different DEX platforms in order to identify the most lucrative exchange routes, which are also referred to as best price routing (BPR).

Aggregators act as an intermediary, creating their own smart contracts and functioning as a bridge between you and the protocols that provide liquidity for exchanging cryptocurrencies. DEX aggregators often offer better privacy and security features, as well as lower fees, since no central authority is involved in the transactions. Examples of DEX aggregators are 1inch, OpenOcean, and CrowdSwap.

- 1inch Exchange – 1inch is a decentralized exchange aggregator that connects to multiple DEXes and liquidity sources, offering users the best available rates for their trades.

- CrowdSwap – CrowdSwap is a new DEX aggregator that has recently gained attention in the cryptocurrency trading community. CrowdSwap connects to multiple DEXes and liquidity sources, providing users with access to the best prices and liquidity for their trades. One of the key features of CrowdSwap is its “liquidity protocol,” which aggregates liquidity across multiple DEXes to ensure that users get the best possible prices for their trades.

- OpenOcean – OpenOcean connects to multiple DEXes and liquidity sources, allowing users to find the best prices for their trades. One of the unique features of OpenOcean is its “router,” which finds the best routes for trades across multiple DEXes and liquidity pools to optimize for the best price and lowest slippage.

What Are CEX Aggregators?

CEX aggregators, on the other hand, aggregate centralized exchanges (CEXes). CEXes are traditional cryptocurrency exchanges that operate with a central authority, which can control the funds and the order books. CEX aggregators connect to multiple CEXes and provide users with access to their liquidity pools and order books. CEX aggregators often offer better trading features, such as advanced order types and trading tools, as well as a broader range of trading pairs.

Some of the benefits of using CEX aggregators include higher liquidity, lower gas fees, and greater trading volume. However, CEX aggregators can also have drawbacks, such as less transparency and security risks associated with centralized custody. The top CEX aggregators are:

- Bitsgap – Offers trading on more than 30 different exchanges, as well as features such as trading bots, backtesting, and a customizable trading terminal.

- Coinigy – Provides access to more than 45 exchanges, advanced charting tools, and mobile trading apps.

- Shrimpy – Connects to more than 20 exchanges and provides features such as portfolio management tools, social trading, and automated rebalancing.

- Altrady – Integrates with more than 20 exchanges and provides features such as advanced charting tools, trading bots, and portfolio management

CEX Aggregators Vs. DEX Aggregators

While both DEX and CEX aggregators aim to provide users with the best prices and liquidity for their trades, there are some key differences between these two types of aggregators. One of the main differences is the level of centralization. DEX aggregators are typically non-custodial and decentralized, meaning that users retain control over their assets and can trade directly from their own wallets.

CEX aggregators, on the other hand, are typically custodial and centralized, meaning that users must deposit their assets into the platform’s custody in order to trade. Another key difference is the level of liquidity. CEX aggregators typically have higher liquidity and trading volume than DEX aggregators, but DEX aggregators offer greater transparency and security. The choice of which type of aggregator to use ultimately depends on the individual user’s needs and preferences.

Trade Effortlessly

Ready to dive deeper? Our crypto exchange is simple and user-friendly, making trading a breeze

Conclusion

In conclusion, exchange aggregators are an essential tool for anyone looking to trade cryptocurrencies across multiple exchanges. Whether you choose a DEX aggregator or a CEX aggregator depends on several factors, including your level of comfort with centralization, the level of liquidity you require, and the importance of transparency and security to you.

By understanding the differences between these two types of aggregators, you can make an informed decision and choose the aggregator that best fits your needs. The main difference between DEX aggregators and CEX aggregators is the type of exchanges they aggregate. DEX aggregators aggregate decentralized exchanges, while CEX aggregators aggregate centralized exchanges. It’s important to note that some cryptocurrency exchange aggregators may aggregate both DEX and CEX exchanges and may offer additional features such as portfolio tracking and advanced trading tools. Additionally, new aggregators are emerging all the time, so they are not limited to only the ones introduced in this article.