In the ever-evolving world of decentralized finance (DeFi), cross-chain swaps have emerged as a groundbreaking technology transforming how digital assets are managed and traded. With each blockchain operating with its own set of rules and protocols, moving tokens seamlessly between different networks has become increasingly crucial. Cross-chain swaps are revolutionizing the way assets move across blockchain networks, making DeFi more accessible and efficient. Cross-chain swaps, also known as atomic swaps, address this need by enabling direct and efficient exchanges of assets across disparate blockchain systems.

What Is Cross-Chain in Simple Words?

Cross-chain technology enables different blockchain networks to interact and exchange information with one another. In essence, it allows separate blockchains—each with its own set of rules and protocols—to communicate and conduct transactions together. This interoperability is essential for creating a more cohesive and versatile blockchain ecosystem, enabling users to seamlessly transfer assets, data, and functionality across various platforms. Cross-chain technology enhances flexibility, broadens liquidity, and supports a broader range of applications by bridging the gaps between different blockchains.

While decentralized exchanges (DEXs) are a prominent use case for cross-chain functionality, this technology has broader applications:

- Decentralized Finance Platforms: Cross-chain technology allows different DeFi platforms to interact, enabling users to leverage assets across multiple ecosystems. This integration facilitates activities like lending, borrowing, and yield farming across various blockchains, enhancing financial opportunities and efficiency.

Learn More: “What is DeFi? (All you need to know about Decentralized Finance)”

- Cross-Chain Bridges: These technologies enable the transfer of assets between blockchains. For instance, you can use a cross-chain bridge to move assets from Ethereum to Binance Smart Chain, facilitating interoperability beyond mere trading.

- Multi-Chain Wallets: Some digital wallets support cross-chain functionality, allowing users to manage and transact with assets from different blockchains through a single interface. This convenience simplifies asset management and enhances user experience.

- Blockchain Interoperability Projects: Platforms like Polkadot and Cosmos focus on creating frameworks for blockchain interoperability, enabling various networks to work together for trading and various applications.

- Cross-Chain Smart Contracts: These smart contracts are designed to interact with multiple blockchains, extending their functionality and use cases beyond a single network. This capability allows for more complex and integrated decentralized applications.

Learn More: “What is a smart contract?”

Advantages of Cross-Chain Swaps

Cross-chain swaps are transforming the DeFi landscape by offering several key benefits:

1. Increased Liquidity and Flexibility

Cross-chain swaps enable users to exchange assets across different blockchain networks without relying on a centralized exchange. This capability opens up a vast liquidity pool, allowing for more efficient and versatile trading. Users can leverage assets from various blockchains, enhancing their trading strategies and access to diverse financial products.

2. Reduced Dependency on Centralized Exchanges

Traditional exchanges often act as intermediaries, introducing additional fees and potential security risks. Cross-chain swaps eliminate the need for these intermediaries by facilitating direct transactions between different blockchains. This reduces transaction costs and mitigates the risk of centralization-related vulnerabilities.

3. Enhanced User Experience and Cost Efficiency

Cross-chain technology enhances the user experience by streamlining the process of swapping assets across blockchains. Transactions are often faster and more cost-effective than traditional methods, providing users with greater convenience and satisfaction. Lower fees and quicker processing times are significant advantages for frequent traders and investors.

Challenges and Limitations

While cross-chain swaps offer numerous benefits, they also come with their own set of challenges and limitations:

1. Security Concerns and Potential Vulnerabilities

Cross-chain swaps involve complex interactions between different blockchain networks, which can introduce security risks. Vulnerabilities in smart contracts, bridge protocols, or underlying technologies could be exploited by malicious actors. Ensuring the security of cross-chain transactions requires rigorous auditing and adherence to best practices in smart contract development.

2. Technical Complexity

Implementing cross-chain swaps needs advanced technology and systems. Managing transactions across different blockchains can be challenging, especially for smaller projects or beginners. Figuring out how different protocols work and ensuring they work together smoothly can be tough.

3. Scalability Issues

As the volume of cross-chain transactions grows, scalability becomes a crucial concern. The infrastructure supporting cross-chain swaps must be able to handle increased demand without compromising performance. Solutions like layer-2 scaling and optimized bridge technologies are being explored to address these scalability challenges.

Why Are Cross-Chain Swaps Important?

Cross-chain swaps play a crucial role in managing the volatility and liquidity challenges inherent in the cryptocurrency market. When the value of tokens fluctuates, as seen during market ups and downs, users face risks of significant losses or missed opportunities. For instance, during a market upswing, tokens in one network may increase in value, while a downturn can lead to devaluation and potential losses. Cross-chain swaps address these challenges by allowing users to move their assets between different networks, thereby protecting their value and mitigating losses. A practical strategy is to swap volatile cryptocurrencies for stablecoins, which helps stabilize the value and reduce market volatility.

Additionally, cross-chain swaps open up new market opportunities. Users can transfer tokens from low-circulation networks to those with higher circulation, enhancing their ability to pay for goods and services or transact with other users efficiently. Without the ability to swap tokens across networks, the utility of digital assets can be severely limited.

Decentralized exchanges have further expanded the functionality and benefits of cross-chain swaps.

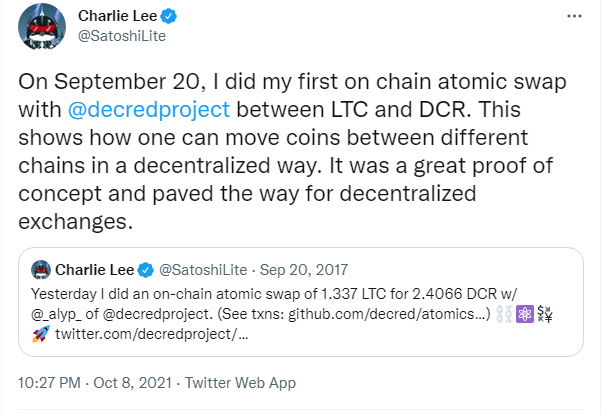

As an early advocate of decentralized systems, Charlie Lee highlighted these technologies’ ongoing growth and potential, emphasizing that cross-chain swaps empower users by enhancing their control over their assets and market interactions.

Looking for a smooth and secure solution for cross-chain swaps?

Discover CrowdSwap, where you can effortlessly manage your swaps using their intuitive and user-friendly app.

Getting Started with Cross-Chain Swaps

If you’re ready to dive into the world of cross-chain swaps, here’s a step-by-step guide to help you get started:

- Choose the Right Platform

Research and select a cross-chain swap platform that aligns with your needs and preferences. Consider factors such as supported blockchains, fees, security features, and user reviews. Choose one that best fits your trading strategy. - Set Up a Compatible Wallet

Ensure you have a wallet that supports the blockchains involved in your cross-chain swap. Some platforms may require specific wallet integrations or configurations. Popular wallets like MetaMask, Trust Wallet, and hardware wallets can often be used for cross-chain transactions but verify compatibility with your chosen platform. - Fund Your Wallet

Deposit the assets you wish to swap into your wallet. Ensure you have enough of the respective cryptocurrencies or tokens to cover both the transaction and any associated fees. Double-check the deposit addresses to avoid any loss of funds. - Initiate the Swap

To initiate the transaction, follow the instructions provided by your chosen cross-chain swap platform. This typically involves selecting the source and destination assets, specifying the amount, and confirming the swap details. Be mindful of the transaction fees and estimated completion time. - Monitor the Transaction

After initiating the swap, monitor the transaction’s progress using the platform’s tracking features. Cross-chain swaps may involve multiple stages or confirmations, so keep an eye on the status to ensure a successful completion. - Review and Confirm

Once the transaction is complete, review the results to ensure everything is as expected. Confirm that the swapped assets have been received in your destination wallet and check for any discrepancies. If you encounter issues, contact the platform’s support team for assistance.

CrowdSwap’s Unique Cross-Chain Solution

CrowdSwap offers a unique cross-chain swap solution that allows users to transfer their assets across different blockchains and ensures the best possible price, thanks to CROWD as the intermediary token.

CROWD acts as a key intermediary in cross-chain transactions, eliminating the need for users to manually compare prices across different DeFi platforms. With this mechanism, users can be confident they get the best swap price without hassle. This approach reduces user costs and increases CROWD’s trading volume, benefiting CROWD holders.

With this innovative method, CrowdSwap makes cross-chain swaps faster, more cost-efficient, and worry-free for users.

To learn more about CrowdSwap’s innovative cross-chain solutions, click here.

Trade Effortlessly

Ready to dive deeper? Our crypto exchange is simple and user-friendly, making trading a breeze

Wrap-Up

Cross-chain swaps mark a significant leap forward in the DeFi space, offering a range of benefits such as increased liquidity, reduced reliance on centralized exchanges, and an enhanced user experience. They enable seamless asset transfers across different blockchain networks, addressing the challenges of market volatility and expanding opportunities for traders and investors alike. However, navigating the world of cross-chain swaps does come with its own set of challenges, including security risks, technical complexity, and scalability concerns.

Understanding these dynamics and choosing the right platform—such as CrowdSwap—can help you make the most of cross-chain technology. By staying informed about the latest advancements and best practices, you can effectively leverage cross-chain swaps to optimize your digital asset transactions and actively participate in the rapidly evolving DeFi landscape. Embracing this technology will enable you to navigate and capitalize on the growing opportunities within the decentralized finance ecosystem, ensuring that you remain at the forefront of innovation in the blockchain world.

FAQ

What exactly are cross-chain swaps?

Cross-chain swaps, also known as atomic swaps, are a technology that enables the direct exchange of assets between different blockchain networks. This process enhances flexibility and efficiency in digital transactions, making it easier to move assets seamlessly between various blockchain systems.

How do cross-chain swaps work?

Cross-chain swaps use smart contracts to facilitate transactions between different blockchains. When a user wants to exchange tokens, the smart contract ensures that the swap happens automatically and securely. It locks the tokens on one blockchain and releases the equivalent amount on another, ensuring that both parties fulfill their part of the transaction before any assets are exchanged.

What are the benefits of using cross-chain swaps?

Cross-chain swaps offer several advantages, including:

- Enhanced User Experience: Transactions are typically faster and more cost-effective compared to traditional exchange methods.

- Increased Liquidity and Flexibility: They allow users to trade assets across different blockchains, accessing a broader range of financial products and markets.

- Reduced Dependency on Centralized Exchanges: They eliminate the need for intermediaries, which reduces fees and security risks.

What challenges are associated with cross-chain swaps?

Despite their benefits, cross-chain swaps can come with challenges such as:

- Security Risks: Complex interactions between blockchains can introduce vulnerabilities. Ensuring security requires careful auditing of smart contracts and bridge protocols.

- Technical Complexity: Implementing and managing cross-chain swaps involves sophisticated technology and can be difficult for beginners or smaller projects.

- Scalability Issues: Handling a growing number of transactions can strain the infrastructure, necessitating solutions like layer-2 scaling.