In this article, we will try to find the simplest possible way to determine the value of a CROWD token. There are many methods from a classical business valuation to apply. However, to begin with, I will concentrate on the revenue-based model. Revenue (before interest and taxes) is a parameter that can be easily determined and extrapolated.

For example, a popular model is to calculate valuation using “multiples”. Here, the turnover is multiplied by a so-called sector multiple. The result shows the value of the company based on revenue. However, revenue alone does not make up the valuation. Other values are included here, which we might look at another time.

The point here is how projects use their revenue. After deducting interest and taxes, what remains is the profit, which flows back into the project. How is the profit used? Is it reinvested in the project to achieve or secure more significant benefits in the future? Or is the profit distributed to the stakeholders? In other words, it’s about how much money is going into growth and value. And that is precisely where the valuation of the CROWD token comes in.

CrowdSwap realizes its revenue through fees on swaps. The “earning fees” are collected in a smart contract and then distributed into three areas, as shown in the diagram.

1. Invest in the project

After the “token genesis event” (TGE), the project has an enormous amount of tokens. These tokens, if they are not immediately needed to pay for expenses in the project or provided for market liquidity, are put into staking. (Before staking is set up, all turnover flows back into the project).

When the revenue is distributed (after interest and taxes), 70% flows into the staking. The percentage of the staking pool held by the project goes back into the project, and 100% is reinvested in growing CrowdSwap. The goal is to continuously improve the capabilities of our team, the app, and the marketing to increase market share (revenue).

2. Staking

The project itself is, of course, not the only staker. Every holder of CROWD tokens is allowed to store CROWD token in the CrowdSwap Staking and thereby earn interest. The respective share in the staking pool defines the share of 70% of the revenue. The more tokens remain in the staking, the fewer are available for trading. The vested amount of tokens stabilizes the price of the CROWD token.

3. Treasury

The remaining 30% of the turnover (after interest and taxes) is divided between the areas of “burn” and “liquidity”, which I do not want to go into detail here. Merely this much that the funds from this area are used to maintain the value of the token. “Burn” has a deflationary effect on the token, “Liquidity” is used without exception for investments in the project. All funds that have not been used from these areas go directly into “Treasury”.

The funds in “Treasury” are invested in a basket of different cryptocurrencies. The following table shows an initial distribution (by market phase):

|

Group |

Percentage (Bear Market) |

Percentage (Bull Market) |

Lending/Staking |

|

Stablecoins |

70 |

50 |

100% |

|

Bitcoin/Ethereum |

25 |

40 |

100% |

|

Promising projects |

0-5 |

10 |

Only in bull runs |

The treasury grows over time based on the revenue of the CrowdSwap project and the interest this basket is generating. Besides that, there is always profit/loss from the volatile assets. We are believers in the crypto space. We believe that the price of these assets will rise over the following decades. For the “promising projects”, loss protection is based on active management and the low percentage value of the treasury overall.

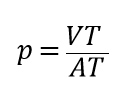

The value of the treasury ensures that the value of a CROWD token is always at least:

p = price of token (intrinsic value)

VT = value of treasury (total)

AT = amount of diluted token (total)

Ongoing turnover and interest will further increase the value of the treasury, thus hedging the value of a CROWD token downwards.

We have identified a small but important factor in the valuation of the CROWD token, which currently accounts for a small proportion of the token’s value. However, it will grow exponentially over time. For the CrowdSwap project, this is an essential part of securing value.

If we take a close look at the distribution of the complete turnover (after interest and taxes), all components of the use of revenue deliver an increase in the value of the CROWD token. Here are all of them again in summary:

Burn: Reduces the number of max supply. Increases the value of the token price.

Liquidity: Reinvested in the project for growth.

Staking: Great incentive to stake CROWD tokens and profit from the success of CrowdSwap.

Project Staking: Share of revenue that flows back into the project and is reinvested for further growth.

Stay in the Loop with CrowdSwap

Jump in and discover the latest updates in the world of CrowdSwap's decentralized exchange

The community will profit from these factors the most. That´s what have in mind for CrowdSwap.

Join us on this discussion on our discord server.