Welcome to our guide exploring a new era in decentralized finance! Here, we’re diving into Exchange-Traded Fund (ETF) investments, with a special focus on CrowdSwap – the first platform ever to smoothly include ETFs in DeFi. Come along as we cover the basics and the interesting history of ETFs, highlighting how CrowdSwap is reshaping how we deal with digital assets. Join us as we uncover the advantages and complexities of ETFs in the crypto world, shedding light on a path that promises simplicity, innovation, and unmatched potential for financial growth. Let’s dive into the evolution and possibilities of ETF investments on CrowdSwap, where the future of decentralized finance unfolds.

What is ETF investment?

An Exchange-Traded Fund, or ETF, is a basket of assets you can buy or sell on the stock exchange. It’s an effective way for investors to diversify their portfolios without having to buy each individual stock or bond. When you have an ETF investment, you buy into a collection of assets that track a particular index, such as stocks, bonds, or commodities. This means you get a slice of various investments in one go, spreading your risk and potentially boosting your returns.

ETFs are known for their simplicity, transparency, and flexibility, making them an accessible and popular choice for novice and experienced investors.

Imagine you’re interested in investing in technology but want to avoid picking individual tech stocks. Instead of buying shares in multiple companies, you can opt for a technology ETF. Let’s call it the “Tech Wonder ETF”. This ETF pools shares from various tech companies like Apple, Microsoft, and Google. When you buy a share of the Tech Wonder ETF, you essentially own a small piece of each of these tech giants. If the technology sector performs well, the value of your ETF shares goes up. Conversely, if one company in the basket doesn’t do so well, the impact on your overall investment is minimized. The ETF structure simplifies the process, offering you diversified exposure to the tech industry in a single, easy-to-manage investment.

In the crypto world, an ETF investment is related to investing in a virtual basket of digital assets you can buy or sell on a cryptocurrency exchange. Think of it as a convenient way to invest in a diverse range of cryptocurrencies without managing each individually. Picture the “Crypto Diversity ETF,” for instance. This ETF might include popular digital currencies like Bitcoin (BTC), Ethereum (ETH), and BNB. When you acquire a share of the Crypto Diversity ETF, you essentially own a fraction of these cryptocurrencies. If the crypto market experiences growth, the value of your ETF shares increases. Conversely, the impact of a decline in one specific cryptocurrency is reduced by the diversified nature of the ETF. Crypto ETFs provide a streamlined and accessible approach for investors to navigate the dynamic world of digital assets.

Explore the following recommended blog for In-Depth knowledge and insights:

The History of ETF Investment

The history of ETFs traces back to the early 1990s. The first ETF, known as the Standard & Poor’s Depositary Receipts (SPDR), was introduced in 1993. Created by State Street Global Advisors, SPDR aimed to provide investors with a cost-effective way to invest in the S&P 500 index. (The S&P 500 index is a stock market index that measures the performance of 500 of the largest companies listed on stock exchanges in the United States.)

This innovative investment vehicle gained popularity due to its ability to combine the features of mutual funds and individual stocks. Over the years, the ETF investment landscape expanded, with various providers introducing ETFs tracking different indices and asset classes. Today, ETFs have become a staple in the investment world, offering investors a diversified and flexible tool for navigating financial markets. The growth of ETFs highlights their adaptability and attractiveness to investors seeking simplicity and efficiency in their portfolios.

In the crypto world, ETFs have recently attracted more attention. The first crypto ETFs appeared in the mid-2010s to meet the increasing demand for easy investment options in the digital asset world. These innovative funds expose investors to a diversified portfolio of cryptocurrencies, such as Bitcoin, Ethereum, and other prominent digital assets. The introduction of crypto ETFs marked a significant step in the maturation of the cryptocurrency market, providing a bridge for traditional investors to participate in the evolving blockchain and digital currency ecosystem. While the crypto ETF landscape is still growing, its inception showcases the adaptability of the ETF model to emerging financial technologies, offering a simplified entry point for investors looking to navigate the complexities of the crypto market.

Until now, ETFs have been common in traditional centralized finance (CeFi), providing investors with diversified and easily tradable portfolios through conventional financial institutions.

In the decentralized finance (DeFi) realm, CrowdSwap has been at the forefront of innovation by introducing the first-ever DeFi ETF.

This pioneering approach reflects CrowdSwap’s commitment to staying on the cutting edge of DeFi and demonstrates the platform’s dedication to offering its community innovative and practical financial solutions.

Be sure to stay with us until the end of this article to learn more about this opportunity with CrowdSwap.

Explore the following recommended blogs for In-Depth knowledge and insights:

- What is DeFi? All you need to know about Decentralised Finance

- CeFi vs. DeFi, What is the difference?

How does ETF investment work in CrowdSwap?

Following the innovation of the Yield Farming Investment Process, which enables users to invest in any farm across any blockchain with just a few clicks and any token, we observed the growing demand for ETFs in the crypto space. This insight led us to integrate our investment process algorithm with the concept of ETFs in DeFi. Thus, we introduced the first-ever DeFi ETF, leveraging our cutting-edge technology to offer a unique investment opportunity.

Investing in an ETF on CrowdSwap is as straightforward as swapping your favorite digital assets. Let’s break it down. ETFs in CrowdSwap comprise a thoughtfully selected mix of tokens like ETH, AVAX, and LINK, each with predetermined allocation percentages. Of course, CrowdSwap chooses the best and strongest tokens to prepare the best offers. Users can effortlessly invest a preferred amount in an ETF, and our platform seamlessly allocates the investment across the ETF’s constituent tokens based on predefined allocations. For instance, let’s say you decide to invest $1000 in our ETF, which consists of 2 tokens, BNB and Ethereum. CrowdSwap swiftly purchases 50% of BNB and 50% of Ethereum on your behalf, securely storing it for you.

Users can invest with any token they want and have in their wallets. Daily growth rates are transparently displayed in the user portfolio. Furthermore, users retain the flexibility to sell their ETF investments anytime, receiving the equivalent value in their wished token supported by CrowdSwap. It’s important to note that this level of flexibility sets CrowdSwap apart from other platforms, including traditional ones like CeFi. When you sell an ETF, you typically receive the equivalent in dollars or euros. However, with CrowdSwap’s DeFi ETF, you can instantly convert it into any token you choose.

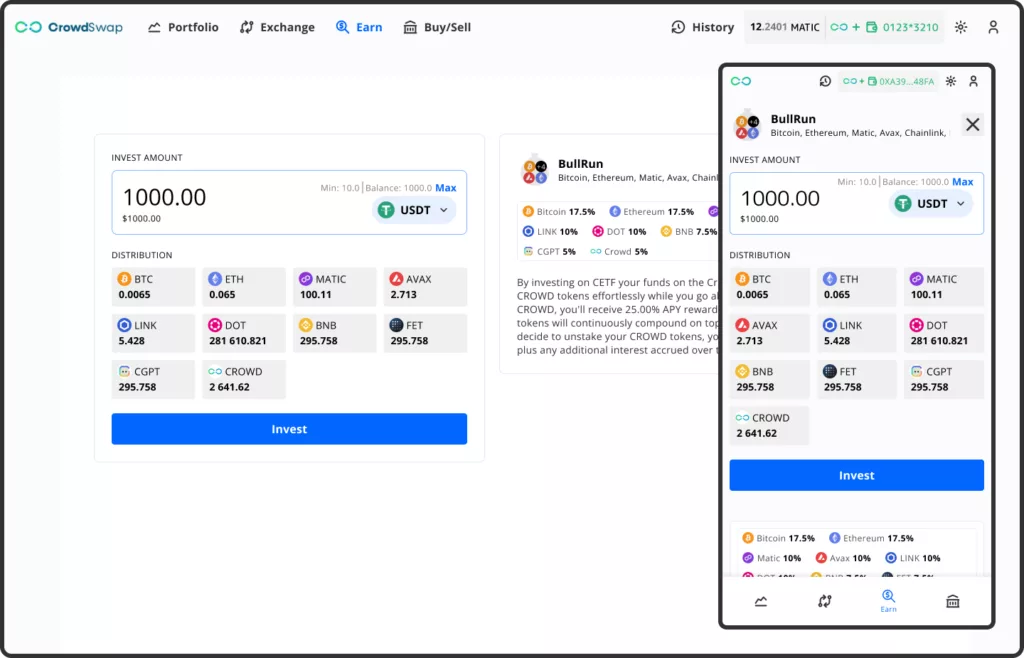

Take a look at the picture below showcasing the BullRun ETF on CrowdSwap as an example.

Upon ETF investment in CrowdSwap, users receive an NFT in their wallets, which is transferable and tradable across various platforms. An NFT, or Non-Fungible Token, is like a special digital certificate that proves ownership of something unique. NFTs that can be sold on any platform have the potential to gain more visibility. This increased exposure benefits creators and sellers looking to showcase their digital assets to a wider audience, attracting more potential buyers and potentially leading to better pricing and liquidity.

Any investor employing a buy-and-hold strategy, for instance, can leverage the advantages offered by ETFs, whether they are novices or seasoned in this field.

Stay tuned as this exciting opportunity seamlessly integrates with CrowdWallet, promising greater ease and convenience. Subscribe to our newsletter or join our communities on social media such as Telegram, Discord, and X to be the first one to receive the news.

Explore the following recommended blog for In-Depth knowledge and insights:

The advantages of CrowdSwap DeFi ETF

Streamlined Entry into Crypto Investments

ETF product enhances simplicity by enabling users to invest in a diversified portfolio of cryptocurrencies through a single ETF. This feature facilitates an effortless entry into the world of cryptocurrency investments, allowing users to begin with a curated selection of tokens.

Save You Time and Money

Navigating investing in different digital currencies can be complicated and time-consuming. Buying tokens individually often involves a cumbersome step-by-step process with fees that span multiple networks. CrowdSwap ETF investment opportunity solves this challenge by simplifying purchases through a one-click process, also saving time and money.

Mitigating Risks Through Diversification

Investing in a singular cryptocurrency token can pose risks due to the inherent volatility of crypto markets. ETF investment mitigates this risk by offering a blend of cryptocurrencies, allowing users to diversify and spread their risk across multiple tokens.

Efficient Portfolio Management

Users can invest a chosen amount into an ETF, and CrowdSwap’s automated platform strategically distributes the investment across constituent tokens based on predefined allocations. This automated management not only saves time but also ensures efficient portfolio balancing. Additionally, the platform empowers users with the unique ability to withdraw their ETF investments anytime, converting the funds into their desired tokens for added flexibility in managing their portfolios.

Flexibility in Investment Choices and Reliable Support

Adding to the convenience, users can sell their ETF investments anytime, receiving the equivalent value in their desired token. CrowdSwap’s commitment to user support is noteworthy, ensuring investors have reliable assistance throughout their investment journey.

Ownership and Control Over Your Crypto Assets

In addition to the advantages mentioned above, CrowdSwap DeFi ETF puts the power in the hands of users. With our platform, you truly own your crypto – your funds are under your control, free from the interference of custodians or third parties. This ensures that your investment remains securely in your possession, allowing for greater independence and peace of mind in managing your digital assets.

Master Crypto with Confidence

CrowdSwap's decentralized exchange offers all the DeFi tools you need, with top-notch support at your fingertips

Wrap-Up

You’re now equipped with the insights to revolutionize your crypto portfolio. The advantages of ETF investments in the crypto realm await your exploration. Ready to take the plunge? Test the revolutionary ETF product on CrowdSwap today and unlock the future of decentralized finance with simplicity and innovation at your fingertips. Your financial journey just became significantly smarter.

FAQ

What is ETF investment in the crypto world?

ETF, or Exchange-Traded Funds, is a virtual basket of digital assets facilitating diversified investment in cryptocurrencies. It provides a convenient way to invest without managing individual tokens.

How does ETF investment work on CrowdSwap?

On CrowdSwap, ETF investments involve a straightforward process of choosing a curated mix of tokens, investing a desired amount, and letting the platform automatically allocate the investment across constituent tokens based on predefined percentages.

What’s the history of ETFs in the crypto realm?

Crypto ETFs emerged in the mid-2010s to meet the demand for easy investment options in the digital asset space. Their inception marked a significant step in the maturation of the cryptocurrency market, bridging the gap for traditional investors.

Why choose ETFs over individual token investments?

ETFs offer a streamlined and accessible approach, saving time and money compared to buying tokens individually. Their diversified nature also mitigates risks associated with investing in a single cryptocurrency.

How does ETF investment on CrowdSwap save time and money?

CrowdSwap’s ETF investment opportunity simplifies the purchasing process through a one-click approach, reducing the complexity and expenses associated with buying tokens individually, making it a time and cost-effective solution for investors.

What is the difference between DeFi ETF and CeFi ETF?

DeFi ETFs, presented by the CrowdSwap platform for the first time, redefine investment accessibility globally. With just one click, anyone can easily invest. However, access may be restricted in CeFi ETF investment. DeFi minimizes intermediaries, promoting peer-to-peer transactions through smart contracts, granting users greater control over their assets. Notably, in a DeFi ETF, you enjoy the flexibility to withdraw and convert your holdings into any token of your choice, unlike CeFi.