Earn Crypto Passive Income

Do you want to earn crypto passive income without any hassle? Then, check out our platform, where you can join our liquidity pools and farm your crypto assets with high returns. Whether you are a beginner or an expert, you can find the best opportunities to grow your crypto portfolio with us. Join now and start earning crypto passive income today!

CrowdSwap pools are available on

What is Yield Farming

Yield farming is a way to earn crypto passive income by funding your assets to the liquidity pools. You can earn rewards in the form of tokens or coins.

We always have a better solution

Traditional process and its complications

CrowdSwap’s unique process

Dual Token Requirement

Consider investing in a Matic/USDC pool. You're required an equal amount of both tokens. If you begin with 1000 Matic, you'll need to convert half into USDC and the amount you receive can vary due to transaction fees and shifts in market value.

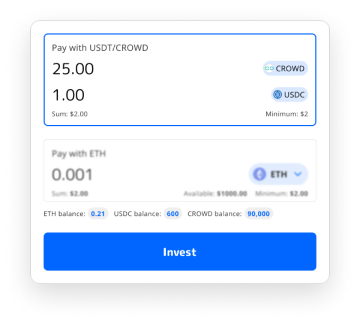

Seamless Token Conversion

With CrowdSwap, you bypass these hurdles entirely. Our platform automates the balancing act between the tokens you want to invest, ensuring you can commit your entire initial amount without the back-and-forth adjustments.

Changing Ratios and Fees

After exchanging 500 Matic for USDC, you end up with 490 USDC. When you attempt to add liquidity, the required ratio might have shifted, demanding 495 USDC instead of 490 due to Matic/USDC rate changes. This leaves you with an imbalance—extra Matic that you didn't intend to have sitting idle.

Direct Full Investment

If you wish to invest 1000 Matic, CrowdSwap's system automatically calculates and converts the exact amount needed into USDC (or vice versa), considering the live exchange rates and fees, ensuring a perfect 50/50 investment.

Separated Transaction Steps

Typically, users looking to provide liquidity must navigate through multiple steps, often involving swapping tokens on one page or platform and then moving to another to deposit their assets into a liquidity pool. This fragmented process can be cumbersome and time-consuming.

Efficiency and Satisfaction

This means you no longer have to manually calculate, swap, and re-balance your investment due to fluctuating exchange rates. CrowdSwap handles the complexity, making your investment process straightforward.

Intra-Chain Limitation

Many liquidity provision platforms operate within the confines of a single blockchain ecosystem, constraining users' ability to invest across multiple chains with tokens from various blockchains. Users must supply the necessary tokens on the blockchain hosting the targeted liquidity pool.

Simplified Cross-Chain Investments

With CrowdSwap, users can easily invest in pools on other chains without the complexity typically associated with cross-chain transactions. This broadens the scope of investment opportunities and streamlines the process.

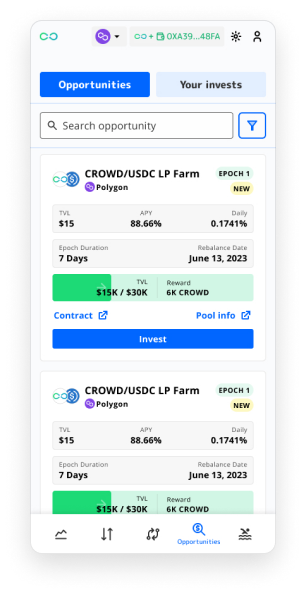

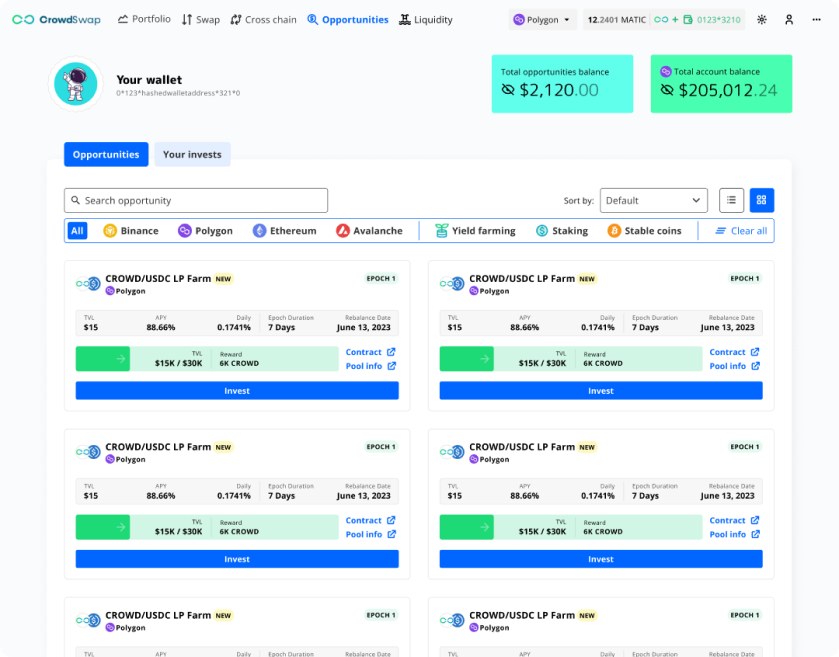

How to Invest in Yield Farming

Explore our step-by-step video guides for each investment method to get started with ease.

Top CrowdSwap Yield Farming Opportunities

CROWD/ARB LP Farm V2

Arbitrum

TVL

APY

Daily

Epoch Duration

Days

Rebalance Date

CROWD/BNB LP Farm V2

BSC

TVL

APY

Daily

Epoch Duration

Days

Rebalance Date

CROWD/OP LP Farm V2

Optimism

TVL

APY

Daily

Epoch Duration

Days

Rebalance Date

CROWD/ETH LP Farm V2

Ethereum

TVL

APY

Daily

Epoch Duration

Days

Rebalance Date

Interested? Explore more CrowdSwap solutions

We offer a variety of different services for all your DeFi needs

ETF

Discover the first-ever DeFi ETF only on CrowdSwap

Portfolio Manager

View all your assets and investments on multiple networks faster than any other platform or wallet

Staking

Are you a long-term holder? Don’t hold CROWD in your wallet! Explore our staking plans

Crypto Exchange

Explore the simplest exchange solution with the best prices on seven networks

CrowdWallet

A Smart Wallet with easy setup, enhanced security, and gasless transactions to simplify your crypto experience

Frequently Asked Questions

Yield Farming generates income through various mechanisms, such as transaction fees, interest, or reward distribution. These earnings are distributed among liquidity providers in the pool based on their contributions.

A liquidity pool is a smart contract that holds a pair of tokens, allowing users to trade between them. Users provide liquidity by depositing an equal value of both tokens, enabling others to trade. Liquidity providers earn a portion of the fees generated from these transactions.

When selecting a liquidity pool, consider factors such as the Annual Percentage Yield (APY) and Annual Percentage Rate (APR), token pair compatibility, and platform security. It’s crucial to research thoroughly and assess your risk tolerance.

You can usually withdraw your funds from a liquidity pool anytime.

Certainly! Here’s a concise and positive take:

Absolutely, Yield farming can be an exciting way to potentially grow your crypto investments over time. It involves earning rewards by staking your digital assets in the DeFi ecosystem. While it requires active engagement and carries some risk, it offers the opportunity for substantial returns, making it an attractive option for those looking to diversify their long-term investment strategy.