CROWD Tokenomics

Driving Value and Innovation

Explore CROWD Tokenomics

Your Path to Secure Investments!

Understanding CROWD tokenomics is vital for investors.

It details how each token’s creation, distribution, and utility boost value and investor interest.

Our transparent budgeting and plans reflect our commitment to sustainable growth and community engagement, which are crucial for long-term success.

Interested in How Your CROWD Tokens Can Gain Value?

Check out the diagrams, table, and numbers below carefully to discover the game-changing CROWD potential

Unlocking Potential Example!

CrowdSwap will soon become a Decentralized Autonomous Organization (DAO). As a result, platform revenue will be distributed among CROWD holders.

For instance, imagine the CrowdSwap platform touches the first milestone of bringing 1 million daily volume transactions.

- With a minimum fee of 1%, the revenue would be $300.000 monthly. (1M * 1% = $10K – Monthly profit = 10K * 30 = $300K)

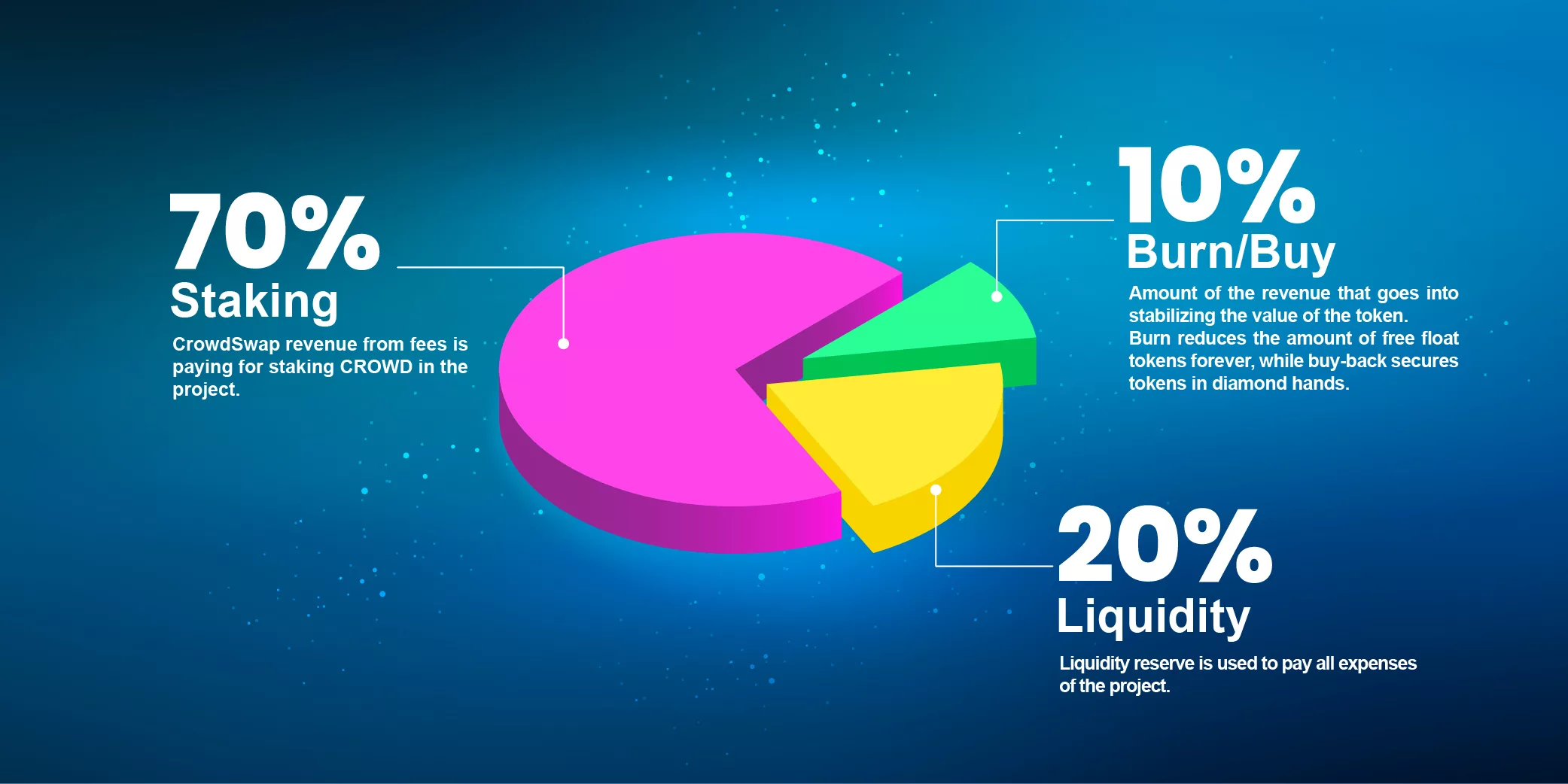

(Some platforms charge over 1% for cross-chain swaps.) - 70% of this revenue will be paid to the CROWD holders. ($300K * 70% = $210K)

- Maximum 400 M CROWD would be in Circulating Supply and assume all these would participate in DAO. ($210K / 400,000,000 = $0.000525 per CROWD)

So, with 100K CROWD, you could earn about $52 monthly. (100K * 0.000525 = $52.5)

APR

12 * $52.5= $630

Daily Earnings

$52.5 / 30 = $1.75

Annual Earnings

$1.75 * 365 = $638.75

Discount Rate

10%

The Present Value of perpetuity

$638.75 / 10% = $6387.5

As the transaction volume on CrowdSwap increases, the revenue generated will also rise.

These estimates are based on minimum transaction volume and fees, but it’s important to remember that transaction volume typically grows over time. With other products contributing to platform earnings and the continuous burn and buyback reducing the circulating supply of CROWD, the token’s price is likely to increase.

Isn’t it interesting?

How will we boost transaction volume?

Extensive marketing activities and implementation of attractive and large campaigns in order to attract new audiences

Providing various and useful products and solutions such as cross-chain and swap widgets, farming and staking opportunities, and first DeFi-ETFs to users and B2B projects

Improving features such as liquidity provisioning and providing a smoother cross-chain service at a higher speed and with a lower fee

Adding new features according to the roadmap to attract and engage new users, such as CrowdWallet and easier interfaces like DeFi Bots

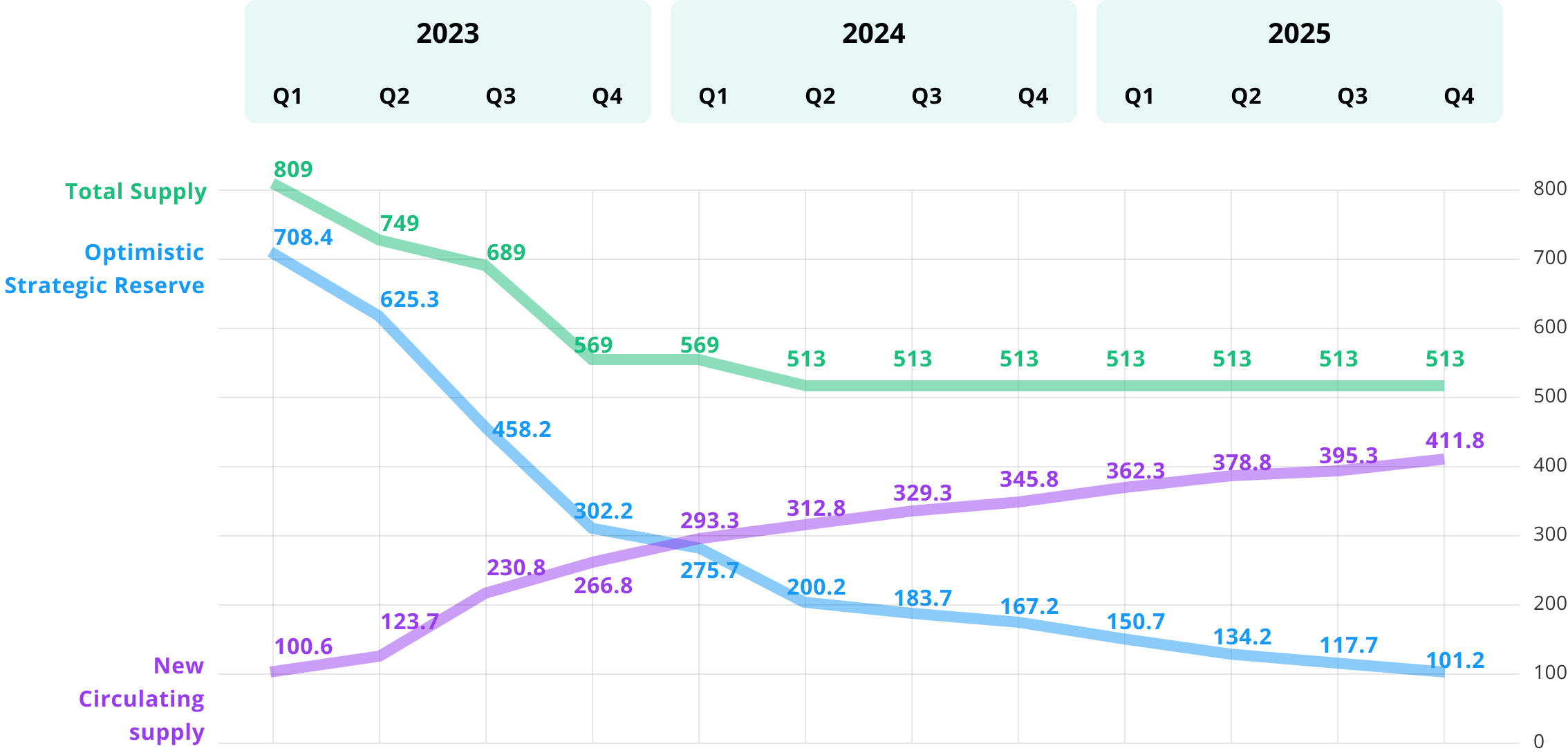

Total vs. Circulating Supply

The diagram below gives you a quick overview of the total vs. circulating supply from 2023 to 2025. We will break down the distribution of CROWD based on liquidity usage down below.

• Token distribution forecast 2025

Token Allocation Breakdown

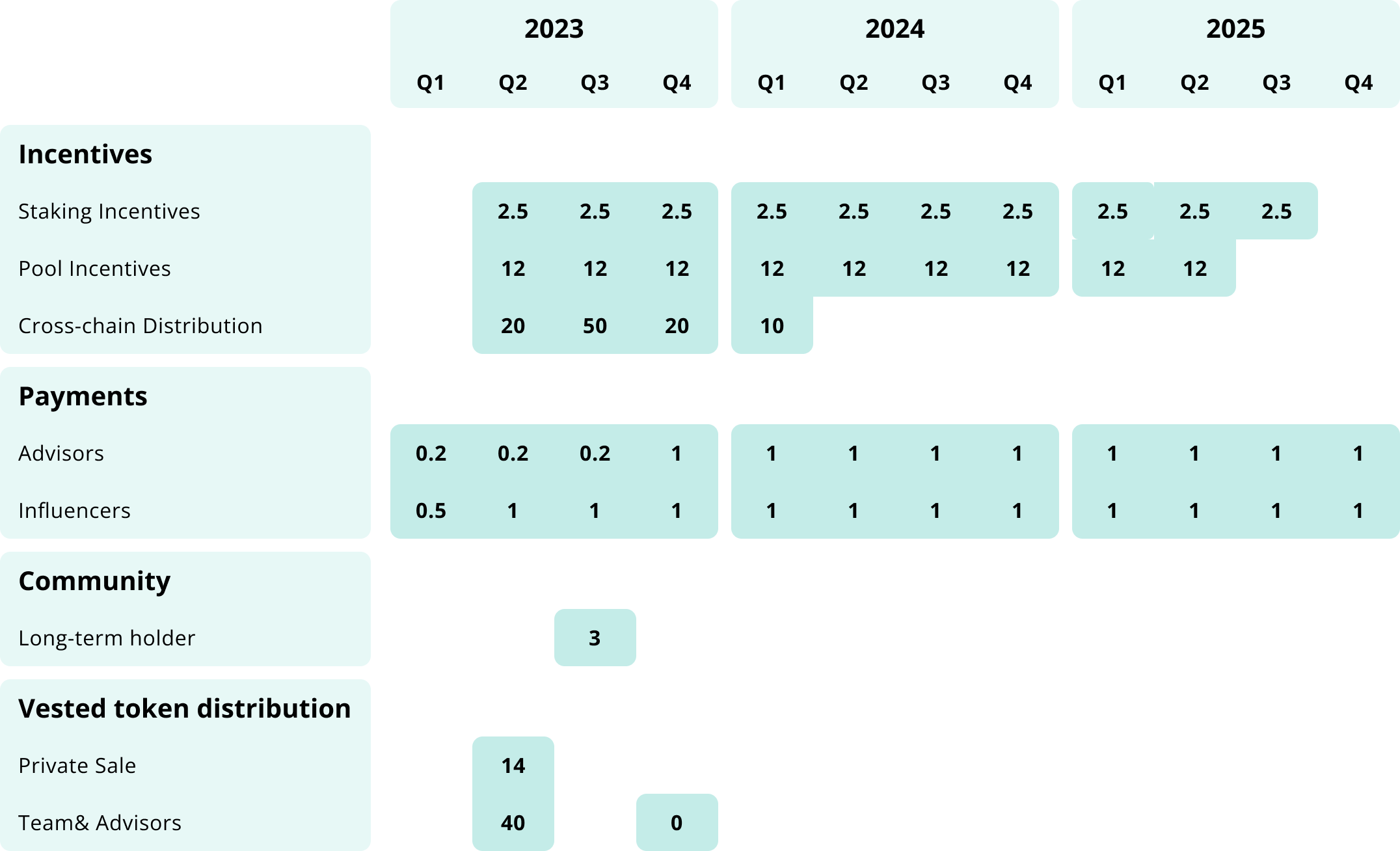

The following table is a detailed breakdown of our planned budget on where CROWD will be spent in our project until 2025.

Each number in the table represents the amount of CROWD allocated to each group; for example, in the second quarter of 2024, 2.5 million CROWD were given as stake incentives.

• The numbers in the table are in millions

DAO Phase Distribution and Revenue Stream

When the DAO starts, the revenue stream will be used to secure the project’s mission and its supporters.

The following numbers are the starting factors; they can be changed based on a valid proposal with appropriate voting and an absolute majority.

Missed the alt

season?

It’s not too late!

CROWD is on a 10x mission

Don’t miss out again!