CROWD Use Cases

Powering Possibilities, Fueling Futures

Missed the alt season?

It’s not too late! CROWD is on a 10x mission. Don’t miss out again!

Use Cases

Missed the alt season?

It’s not too late!

CROWD is on a 10x mission

Don’t miss out again!

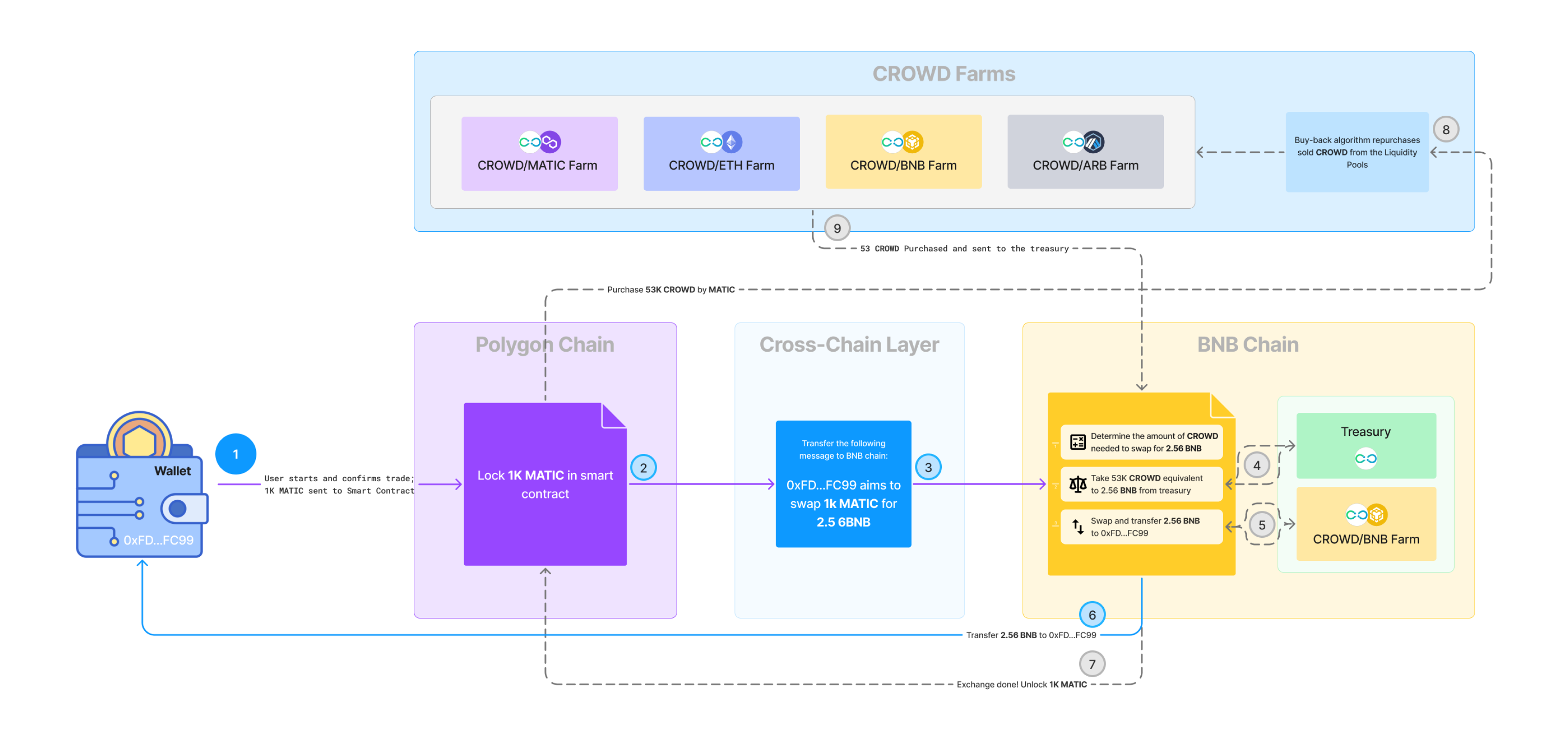

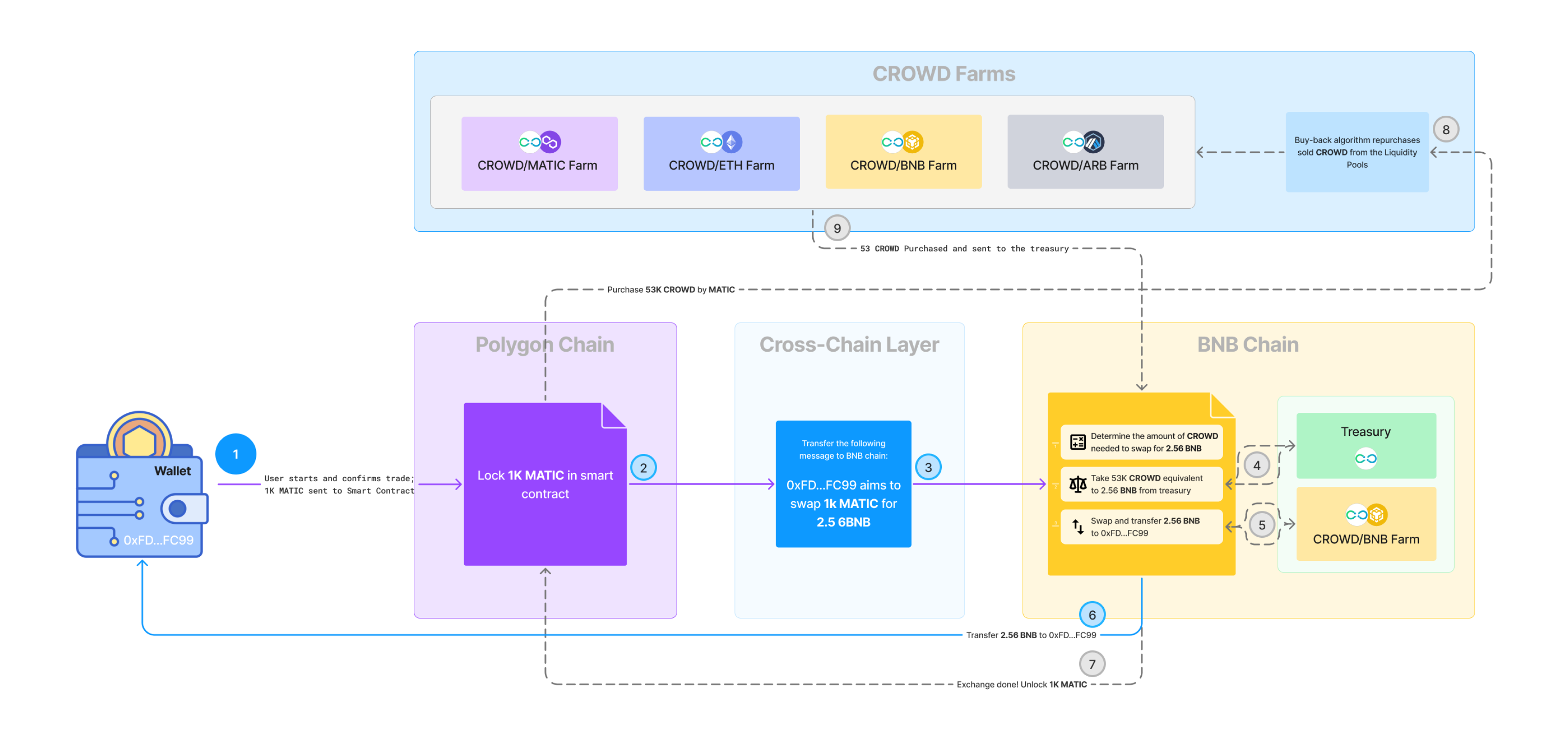

Cross-Chain Facilitator

Liquidity provision in cross-chain transactions represents a significant challenge within the blockchain domain. By leveraging CROWD as a key liquidity source for Cross-Chain trades, CrowdSwap ensures required liquidity while delivering optimized pricing. This approach results in lower fees and superior swap rates on bridges, streamlining the trading experience.

Effortlessly swap your favorite cryptocurrencies across different networks

Consider the diagram below as an example.

Exclusive VIP Access

CrowdSwap VIP program is not like any other platform. It allows members to share in the revenue generated from Cross-Chain swaps. Here's how it works:

VIP Stages and Revenue Share

Bronze

20% revenue share

Silver

30% revenue share

Gold

50% revenue share

The total revenue shared with VIP members is 0.5% of the processed cross-chain volume. It only includes transactions that use liquidity from CrowdSwap liquidity pools and have CROWD as its intermediary token (CROWD Route).

ⓘ CrowdSwap does not generate 0.5% revenue from other routes at the moment but in the future, we may be able to share that with VIP members as well.

It also excludes CROWD bridges, as most of the revenue from those transactions is allocated to the pools as incentives and another portion will be burned.

Example:

Daily Volume

$50,000

Total VIP Share

$250 Daily / $90,000 Annually

The Revenue shares are distributed in USDT or USDC, giving each VIP point a clear dollar value.

Increasing CROWD’s Value:

The primary way to enter the VIP program is by purchasing and holding CROWD in one of the provided options. As more revenue is shared, demand for CROWD increases, driving its value upward.

There are approximately 195 million points currently in the VIP program. If CrowdSwap processes $1 million in cross-chain transactions daily— a very feasible market target —each 1,000 points would hold a value of $0.025. Since the primary way to earn VIP points is by buying CROWD, this would significantly increase the demand and value of CROWD.

CROWD As Collateral For Node Validators

Our cross-chain solution relies on Node Validators to function optimally, just like any other solution in the market. Currently, 11 nodes are actively validating transactions.

What Are Node Validators?

Node validators are individuals or entities responsible for verifying and validating transactions, ensuring swaps are accurate and trustworthy. In cross-chain setups, they enable secure communication between blockchains, facilitating safe and efficient asset exchanges. Validators play a vital role in maintaining network integrity and decentralization.

Anyone who wishes to become a Node Validator can do so but, to ensure accountability and security, validators must stake tokens as collateral. This prevents fraudulent behavior, as any misconduct risks the loss of their staked assets. At CrowdSwap, the process is the same, Anyone can become a node validator but they must stake a significant amount of CROWD to get started.

Rewarding and giving incentives

Achieving CrowdSwap's vision requires commitment from both investors and the community. Investors (for instance, on liquidity pools or staking opportunities) fuel CrowdSwap by providing liquidity, so they deserve rewards for their contributions. These rewards are given in the form of a CROWD.

Fueling growth, rewarding commitment - CROWD powers CrowdSwap's ecosystem

Additionally, participants in bug bounty programs will be rewarded with CROWD, further enhancing platform security and community involvement. Also, prizes from some campaigns will be given to the participants through CROWD.

Joining DAO Governance

Joining the DAO (Decentralized Autonomous Organization) empowers CROWD holders to have a voice in the decision-making processes of CrowdSwap’s development, shaping the platform's future and a share in revenue distribution.

The more CROWD, The more voting power, The more income

The platform's earnings serve multiple purposes. 70% of the earnings go to CROWD holders, while 20% covers operational costs, and the remaining 10% is allocated towards burning and buybacks.

Transactions Fee Cashback

Through various trading programs and campaigns, traders are rewarded with CROWDs through diverse trading programs and campaigns. With each exchange facilitated on the platform, users effortlessly receive a portion of their transaction fees reimbursed in CROWDs, promoting engagement and enhancing the trading experience.

Earn CROWD as you trade, Enhancing your experience

How does the CROWD generate and preserve its value?

Over the past few years, CrowdSwap has developed multiple features with CROWD as a central element. Attracting more users and increasing usage has generated greater value and positioned CROWD for enhanced worth, especially with the anticipated launch of our DAO in the near future. Additionally, an automated burning plan integrated into our cross-chain operations acts as a deflationary mechanism, aiming to increase its value over time.

CROWD is available on reputable platforms