Your Project Needs

Revenue!

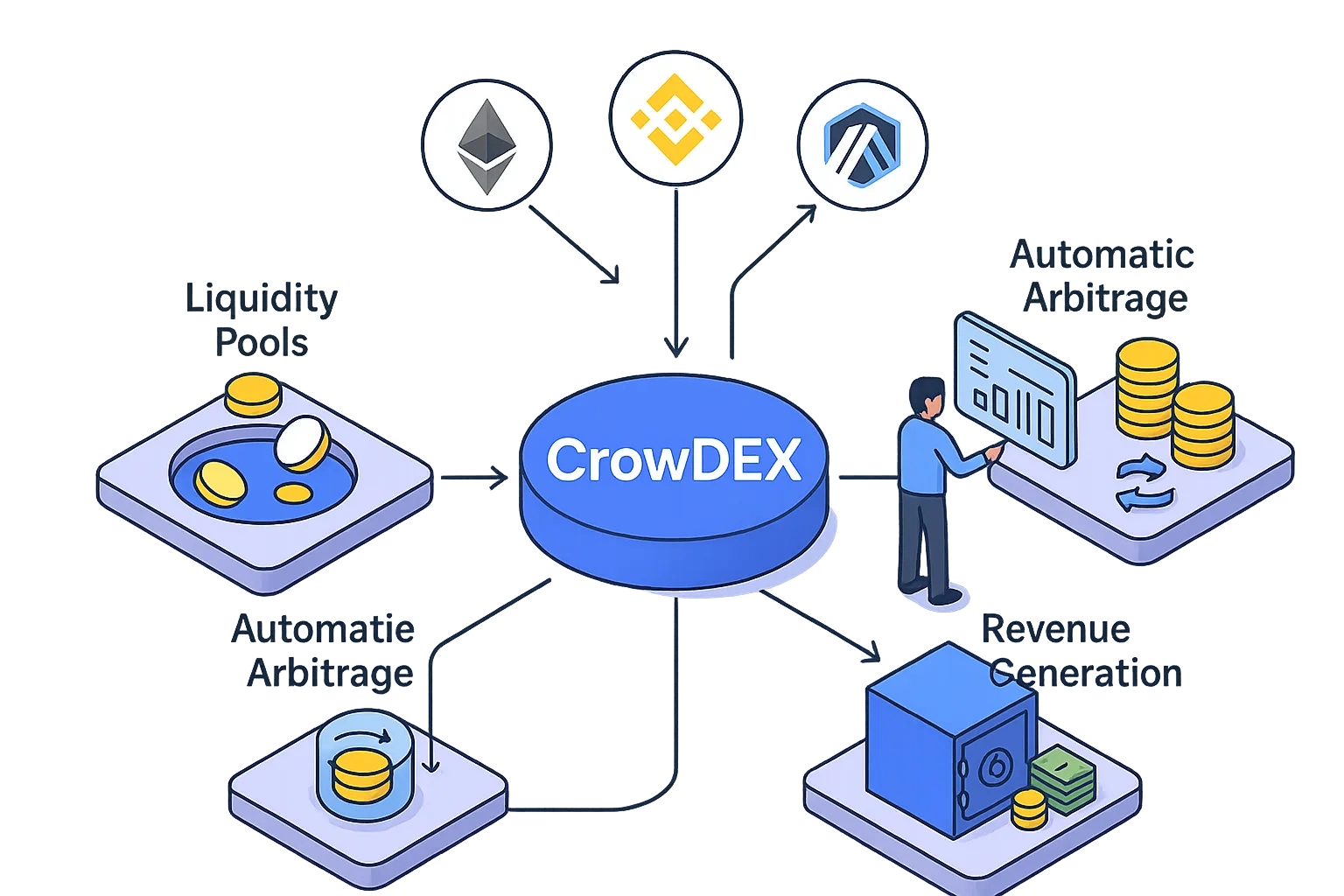

CrowDex is a unique all-in-one liquidity pool solution designed to generate real revenue, not token inflation through incentives.

This system includes a market-making tool, an arbitrage module, and a trading component that can deliver profits for your project and community on demand.

Automatic Arbitrage

Let your project capture the profits from arbitrage opportunities, instead of external arbitragers

No More Inflation

Eliminate the need to incentivize liquidity pools with your token and avoid unnecessary inflation

Actual revenue

The trading feature grows your treasury and generates real, sustainable income for your project

Why CrowDex?

The first and often biggest challenge for any crypto project is selling its token. What’s even harder is giving people a reason to hold it, and hardest of all is building a revenue stream early on.

CrowDex is designed to help your project enter the crypto space with confidence. Your community can invest in the liquidity pool of your token, which is created through CrowDex. From there, our trader and arbitrager components use those funds to generate profits and deliver an attractive APY in stablecoin.

This turns their investment into a real, rewarding opportunity, making it easier for them to choose your token and stay committed.

At the end, you can decide how much of that profit is shared with the community and how much goes toward supporting and growing the project itself.

CrowDex vs. Traditional DEXes

Creating a liquidity pool is the first step to take in the DeFi world. Take your first step smarter!

Feature

CrowdSwap

UniSwap

PancakeSwap

Liquidity Pool Creation

✔️

✔️

✔️

Revenue Stream (Project & Liquidity Provider)

✔️

✖️ (Only Liquidity Provider)

✖️ (Only Liquidity Provider)

Automatic Arbitrage

✔️

✖️

✖️

Embedded Market Making & Trading

✔️

✖️

✖️

Fixed APY

✔️

✖️

✖️

UniSwap

PancakeSwap

Features That Empower Your Project

Automatic Arbitrage

CrowdSwap has an arbitrage component that allows your project to gain from price differences across your token’s liquidity pools to generate profit that would otherwise go to external arbitragers

No More Inflation

Instead of incentivizing your liquidity pool with your own token and creating inflation, you can reward liquidity providers with stablecoins. These incentives come directly from the trading component, which generates profit using the pool’s funds

Revenue Stream

By launching your liquidity pool with the support of CrowdSwap’s trading and arbitrage systems, you create a sustainable revenue stream and actively build your project treasury

Trading

CrowdSwap’s trading component uses the funds in your liquidity pool to generate consistent profits with minimal risk

Market Making

Our system also acts as a market maker through continuous buying and selling, but unlike traditional market makers, it doesn’t rely on large capital or charge high fees. Instead, it is designed to generate profit

Opportunity for Token Holders

If your project chooses to share revenue with its token holders, CrowdSwap can facilitate that as well, allowing you to offer attractive APYs and reward your most valuable supporters: your community

Frequently Asked Questions

What makes CrowDex different from platforms like UniSwap or PancakeSwap?

CrowDex isn’t just a liquidity pool—it’s a complete revenue engine. While traditional DEXes only provide a place to create a pool, CrowDex goes further by offering built-in arbitrage, trading, and market-making tools that actively generate income for your project, without relying on inflationary token rewards.

How does CrowDex help prevent token inflation?

Unlike traditional DeFi models that incentivize liquidity with your native token (increasing inflation), CrowDex generates revenue from trading activity and arbitrage, allowing you to reward users with stablecoins instead, keeping your token supply stable and your economy healthier.

Do I need to provide extra capital or give up treasury control to use CrowDex?

No, you retain full control. CrowDex operates using the funds you place in the liquidity pool and doesn’t require access to your treasury or additional capital commitments. You can withdraw your funds at any time.

How CrowdSwap can help you in your business?

Tell us a little about your product by filling the form or email us. we will contact you in 24 hours.